Sui has entered a technical bear market after falling nearly 40% from its highest level this year.

The Sui (SUI) token has dropped to $3.25, down from its all-time high of $5.36, bringing its market capitalization to $9.8 billion.

The recent decline mirrors the performance of other altcoins that have erased some of their fourth-quarter gains. Layer-1 tokens such as Solana (SOL), Ethereum (ETH), and Polkadot (DOT) have also entered bear market territory, each falling over 30% from their peak.

Despite the decline, there are several reasons why Sui could rebound by 65% and retest its all-time high of $5.36. One key factor is Sui’s growing presence in key sectors of the crypto industry.

For example, DeFi Llama data shows that Sui has become the sixth-largest blockchain in the decentralized exchange industry. Protocols in its ecosystem handled over $2.28 billion in transactions in the past seven days, bringing the total volume to $65 billion. The leading platforms in the network include Cetus, Bluefin, DeepBook, and Turbos.

Sui has also become the ninth-biggest chain in crypto in terms of its total decentralized finance assets. Its DeFi TVL has moved to over $1.45 billion, making it bigger than other blockchains like Avalanche, Cardano, and Polygon.

Additionally, Sui is working to establish itself in the gaming sector. The network is preparing to launch Sui Play, a gaming console that will feature hundreds of games.

Sui price forecast

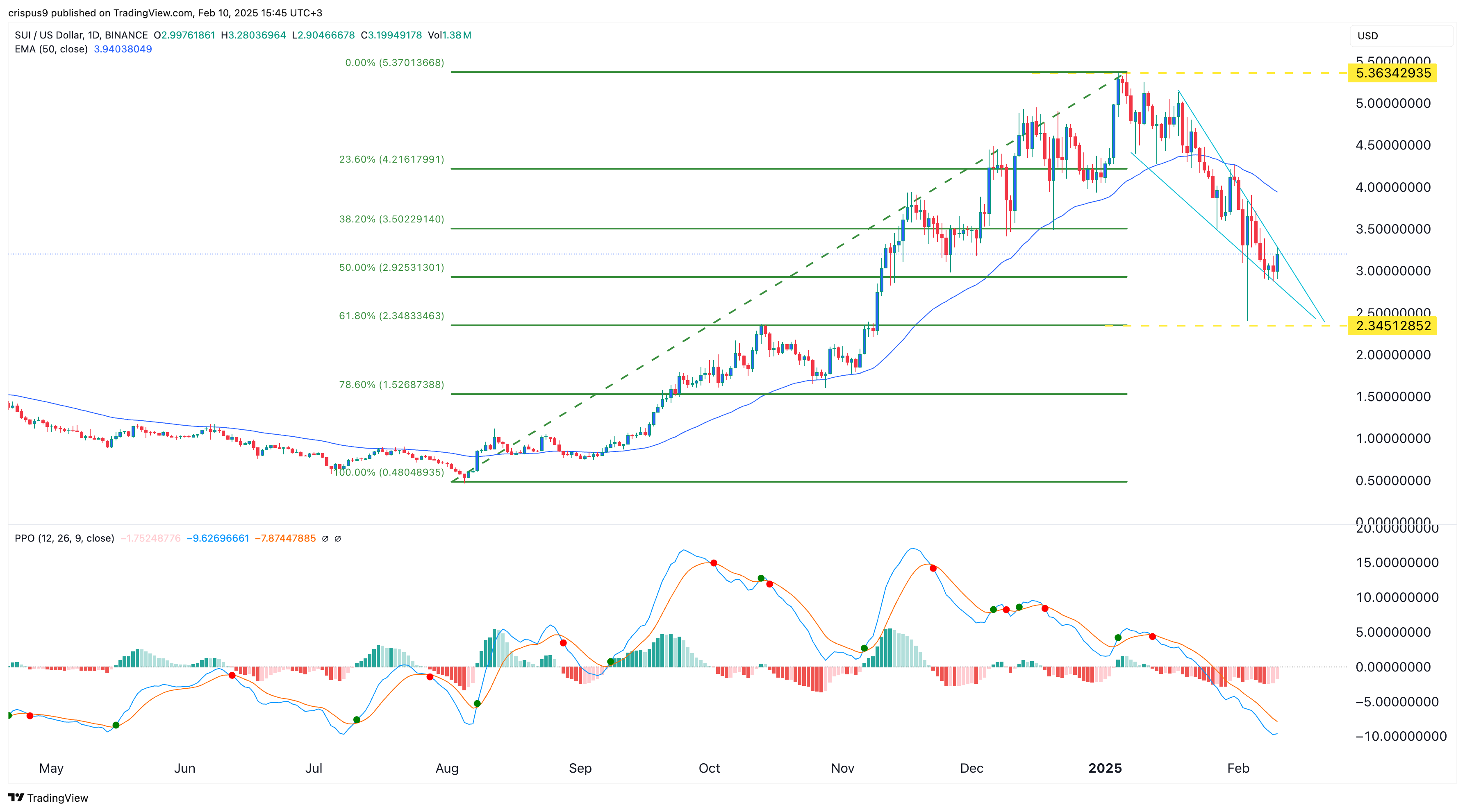

The daily chart shows that the Sui token peaked at $5.36 earlier this year before plunging to $2.34 last week, following a broader altcoin sell-off triggered by Trump’s tariffs. This bottom level coincided with the 61.8% Fibonacci retracement level, a key support area derived from the golden ratio in the Fibonacci sequence.

Sui has also formed a falling wedge pattern, a common bullish reversal indicator. This pattern consists of two descending and converging trendlines, with a breakout typically occurring when the lines are about to converge.

As a result, Sui is likely to rebound and potentially retest its all-time high of $5.36, which would represent a 65% increase from its current level. However, a drop below the support level at $2.35 would invalidate the bullish outlook.