PENGU rallied for the fourth consecutive day, driven by bullish technical indicators and rising adoption trends.

According to data from crypto.news, Pudgy Penguins (PENGU) surged to a high of $0.0154 on June 30 during afternoon trading in Asia, its highest level since May 15. The token has now climbed nearly 80% from its seven-day low and is up over 300% from its year-to-date bottom.

The latest leg of PENGU’s rally began after the Chicago Board Options Exchange (CBOE) filed a Form 19b-4 with the U.S. Securities and Exchange Commission on June 26, seeking approval to list and trade the Canary PENGU ETF, which would hold both the PENGU memecoin and Pudgy Penguin NFTs.

Adding to the narrative, the Pudgy Penguins’ mascot recently appeared at Nasdaq MarketSite alongside VanEck’s Head of Digital Assets Research, Matthew Sigel, who rang the opening bell. The event served as a symbolic moment of institutional validation, which seemed to have sparked renewed investor interest.

PENGU made headlines once again after the UK-based fintech platform Revolut listed PENGU on June 27, giving over 50 million European users direct access to the token.

Further, it also secured a listing on crypto exchange Biconomy.com with trading set to begin on June 30.

As previously reported by crypto.news, Pudgy Penguins NFTs have also recorded a significant increase in sales over the past week.

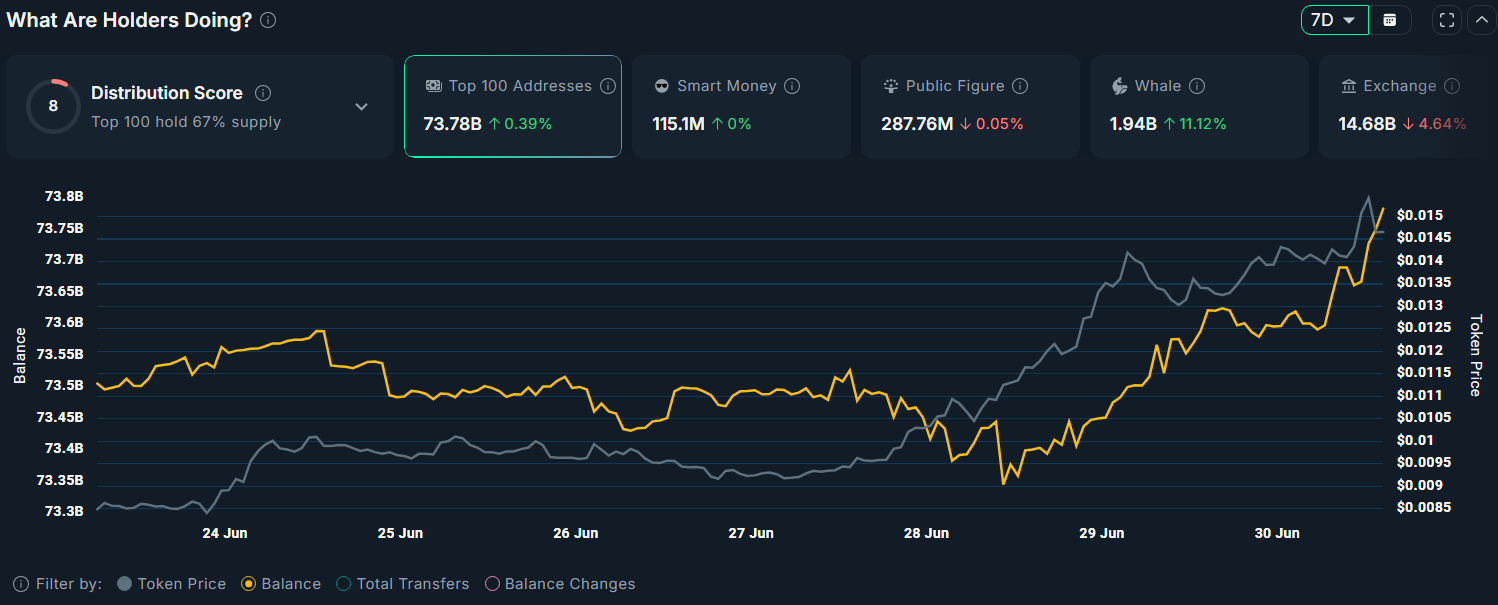

At the same time, whales were seen actively accumulating PENGU to capitalize on its recent price surge. Nansen data shows that whale addresses now hold 1.94 billion tokens, an increase of over 11.1% over the last 7 days.

These developments are collectively reinforcing bullish sentiment among PENGU investors and are expected to contribute to continued upward pressure on the token’s price.

PENGU price analysis

From a technical standpoint, PENGU recently broke out above the upper boundary of a multi-week descending channel on the 1-day/USDT chart, signaling the end of its previous corrective phase.

Momentum indicators support further upside with the 20-day Simple Moving Average poised to crossover the 50-day SMA, a formation commonly referred to as a golden cross, typically a bullish trend confirmation. Additionally, the MACD lines have flipped positive, suggesting strong upward momentum.

Therefore, the next key resistance lies at $0.0175, the intraday high from May 14, which represents a 15% upside from current levels. A breakout above this level could open the path toward the $0.023 level, which aligns with a key Fibonacci extension level.

Despite the bullish setup, PENGU may face a short-term pullback, as the Relative Strength Index is approaching overbought territory, indicating a potential pause before the next upward move.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.