Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

Summary

- Bitcoin ETFs post $88M inflows after three days of $403M outflows.

- IBIT and FBTC drive all flows as most funds remain inactive.

- Weekly redemptions continue with $315M leaving BTC products.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin (BTC) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

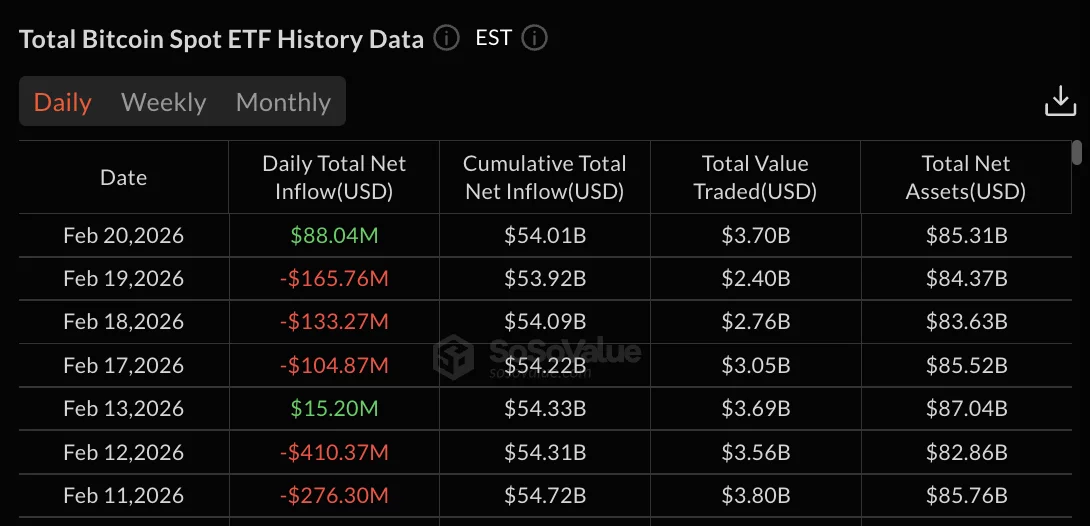

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

Three-day Bitcoin ETF outflow streak totaled $403 million

February 17-19 posted consecutive days of redemptions before February 20’s reversal. February 19 recorded the largest single-day withdrawal at $165.76 million.

This was followed by February 18’s $133.27 million and February 17’s $104.87 million in outflows.

The selling pressure dropped total net assets from $87.04 billion on February 13 to $85.31 billion on February 20.

February 13’s $15.20 million inflow briefly interrupted the pattern before three days of sustained withdrawals resumed.

Most Bitcoin ETF products recorded zero activity on February 20, with only IBIT and FBTC posting flows.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all showed no movement.

BlackRock’s IBIT maintains $61.30 billion in cumulative net inflows. Fidelity’s FBTC holds $10.96 billion in total inflows.

Weekly outflows persist at $315 million

The week ending February 20 posted $315.86 million in net outflows and was the fourth consecutive weekly redemption period.

The week ending February 13 recorded $359.91 million in withdrawals, while the week ending February 6 saw $318.07 million in outflows.

Late January posted the heaviest weekly redemptions. The week ending January 30 drained $1.49 billion from Bitcoin ETFs, while the week ending January 23 recorded $1.33 billion in withdrawals.

The four-week outflow period from January 23 through February 20 totals approximately $2.48 billion.

Weekly trading volume reached $11.91 billion for the period ending February 20, down from $18.91 billion the previous week.