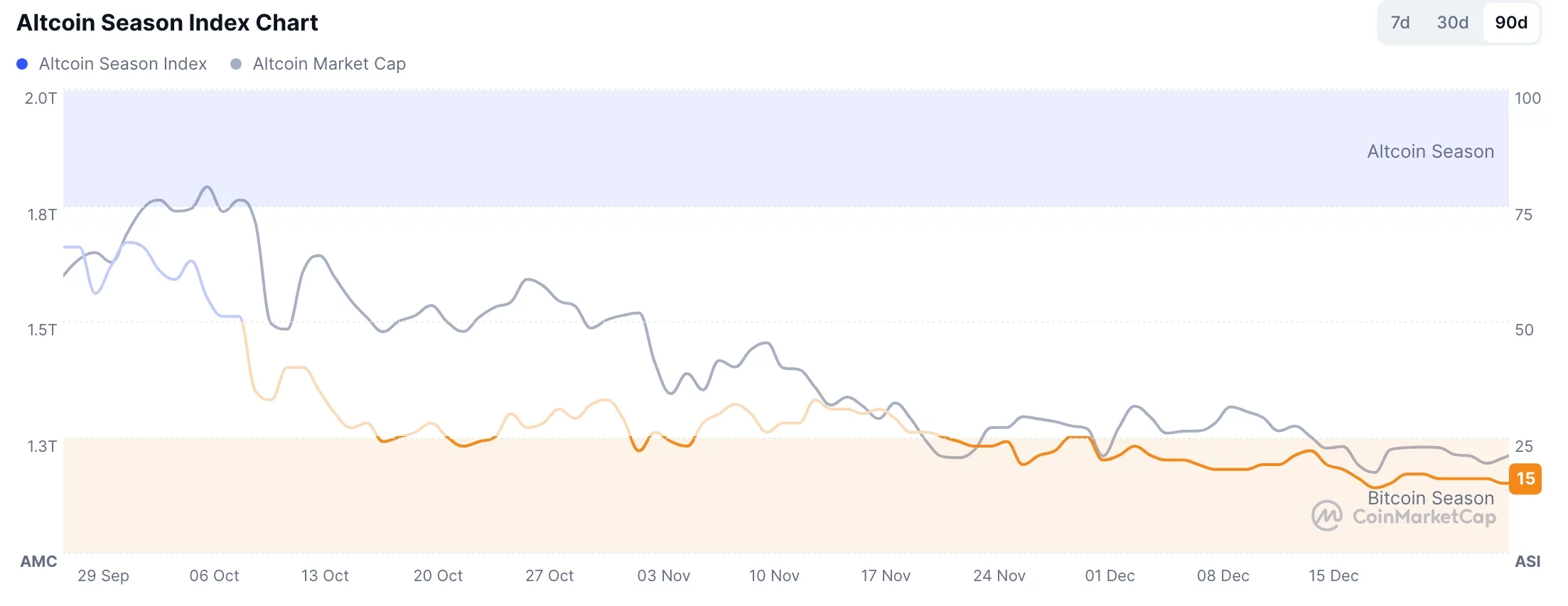

The Altcoin Season Index continued its downward trend this week as Bitcoin dominance accelerated.

Summary

- The Altcoin Season Index has plunged to 15.

- The market capitalization of all altcoins has plunged.

- This market valuation has formed a double-top pattern.

The index, which tracks the performance of altcoins against Bitcoin (BTC), declined to 15, the lowest level this year. This decline continued as most altcoins remained in the red.

Data compiled by CoinMarketCap shows that only a handful of cryptocurrencies have risen in the last 90 days. Pippin token jumped by over 2,300%, making it the best-performing major tokens. The other notable gainers were privacy names like Zcash, Dash, Monero, and Merlin Chain.

On the other hand, tokens like DoubleZero, Story, MYX Finance, Immutable, and Pudgy Penguins were among the top laggards as they dropped by over 60% in this period.

These altcoins have underperformed the broader market as the Crypto Fear and Greed Index dropped to the fear zone of 25. It also happened as investors continued to reduce their leverage as evidenced by the falling open interest.

The deleveraging accelerated after the October 10 situation, where over 1.6 million traders experienced a $20 billion wipeout. This wipeout has led to less demand for altcoins, which are considered riskier than Bitcoin.

Most notably, the Altcoin Season Index also dropped because of the ongoing Bitcoin decline. Historically, altcoins tend to experience steeper drops when Bitcoin is falling.

Altcoin Season could be at risk as a double-top forms

The three-day chart shows that the total market capitalization of all coins excluding Bitcoin and Ethereum has dropped from $1.19 trillion in October to the current $825 billion.

The valuation could be at risk of a steeper drop as it formed a double-top pattern at $1.16 trillion and a neckline at $658 billion. It also moved below the 38.2% Fibonacci Retracement level.

The market cap has also dropped below the 50-day and 200-day Exponential Moving Averages, a sign that bears remain in control. Also, the Relative Strength Index and the MACD have continued falling in the past few months.

Therefore, the most likely outlook is where altcoins continue falling as sellers target the 50% retracement at $739 billion. A drop below that level may lead to further decline to the neckline at $658.