U.S. jobs growth in May was in line with expectations, suggesting that the Fed may keep rate cuts on schedule.

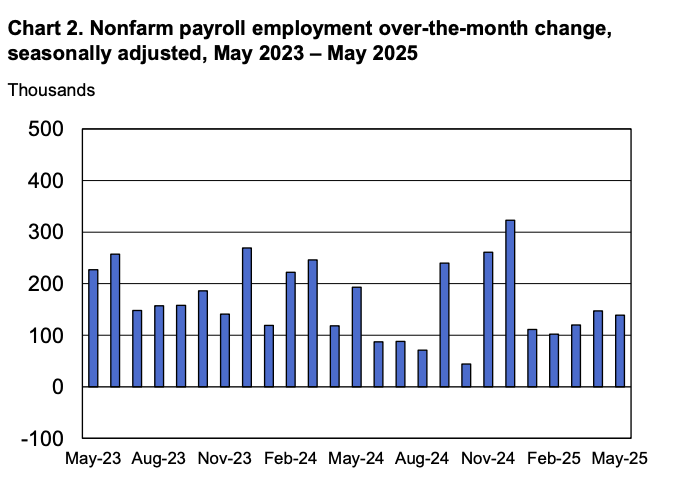

Despite earlier expectations, U.S. jobs data was not the major crypto market mover this week. On Friday, June 6, U.S. hiring slowed, with employers adding 139,000 new jobs. While this figure was lower than the revised 147,000 for April, it was still slightly above the forecasted range of 125,000 to 130,000.

At the same time, the unemployment rate remained at 4.2%, a relatively low figure for the metric. Notably, government jobs accounted for 22,000 of the jobs lost, painting an even stronger picture for the private sector. While these figures are not particularly bullish for Bitcoin (BTC), they are unlikely to have triggered the recent market slump.

In reality, employment data was completely overshadowed by the public split between President Donald Trump and billionaire Elon Musk. Still, macro factors will continue to play a key role in Bitcoin’s performance in the near future.

Bitcoin traders anticipate the Fed’s next moves

With the jobs data meeting expectations, the Federal Reserve will likely maintain its cautious stance on interest rates. According to analysts at Bitfinex, the jobs figure is one of the key metrics the Fed uses to guide its policy direction.

Relatively strong employment data means the Fed feels less pressure to reduce interest rates to stimulate the economy. Instead, it will likely remain laser-focused on inflation, which it sees as a major risk tied to Trump’s trade policy.

In this context, high interest rates will likely help strengthen the dollar and weigh on Bitcoin ETF flows. Still, the macro environment remains in flux, and reversals are more than possible. At this time, even the Fed is cautious about shifting its policy in either direction.