Digital asset inflows hit over $2 billion last week, fueled by Trump inauguration enthusiasm, with total assets under management reaching more than $170 billion.

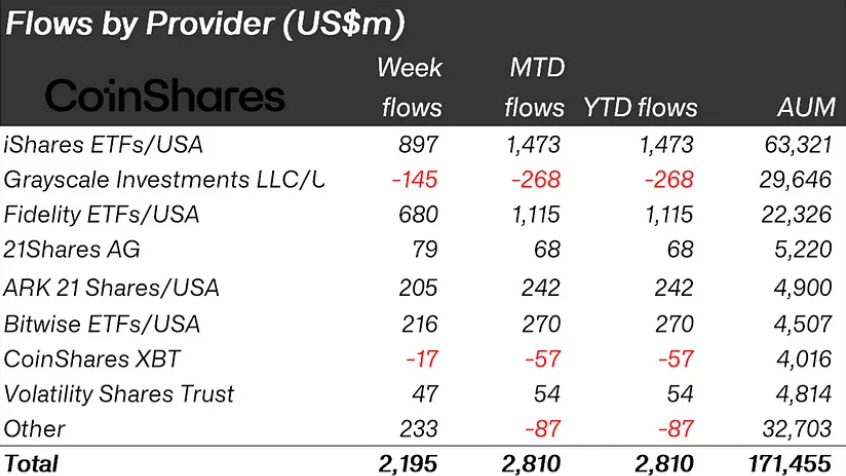

Crypto investment products saw inflows of $2.2 billion last week, according to data from European alternative asset manager CoinShares. In a blog post on Jan. 20, James Butterfill, head of research at CoinShares said the latest development marks the largest weekly inflows so far in 2025, attributing the surge to the Trump inauguration euphoria.

Total assets under management hit $171 billion, reaching an all-time high, Butterfill revealed, adding that trading volumes on exchange-traded products were also high, hitting $21 billion last week, accounting for 34% of bitcoin trading volumes on trusted exchanges.

Bitcoin (BTC), as with previous cases, led the inflows, bringing in $1.9 billion. Year-to-date inflows for BTC now stand at $2.7 billion, CoinShares says, noting that “unusually, despite the recent price rises, we have seen minor outflows from short-positions.”

Ethereum (ETH) had inflows of $246 million, reversing earlier outflows this year. XRP (XRP) also saw $31 million in inflows last week, pushing its total since mid-November to $484 million. Smaller inflows were recorded for Stellar (XLM), with $2.1 million, while other altcoins saw little activity.

The U.S. dominated inflows regionally, pulling in $2 billion. Switzerland and Canada also contributed with $89 million and $13 million, respectively. CoinShares notes that Ethereum remains the “poorest performer from a flow perspective so far this year,” despite last week’s gains, while Solana’s (SOL) inflows were a modest $2.5 million.