Swiss francs and gold have become some of the best safe-haven assets as the stock and bond market turmoil continues.

The USD/CHF exchange rate tumbled to 0.8100 on Friday, 12% below its highest point in 2024. This performance has made the Swiss franc one of the best-performing currencies this year.

The Swiss franc’s performance was the polar opposite of the U.S. dollar’s, which tumbled to 2018 lows. Its performance is primarily due to Switzerland’s neutrality and banking secrecy laws, which have always made it a haven.

The Swiss National Bank (SNB) is a major investor in U.S. markets and holds substantial positions in many top American companies — including household names like Apple, Microsoft, Amazon, and Alphabet. It is also the tenth-biggest holder of US Treasury bonds.

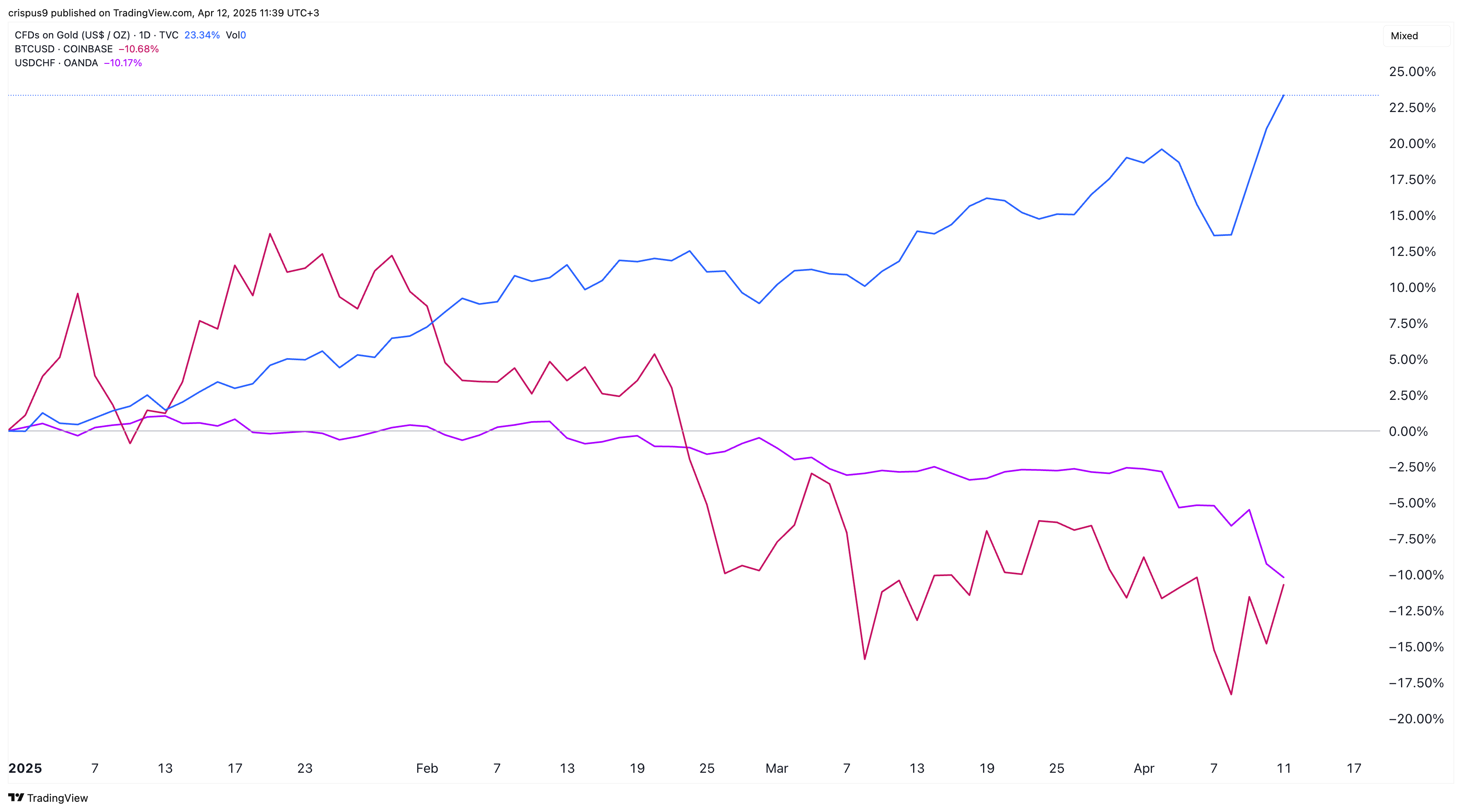

Gold has also become a top haven, with its price soaring to a record high of $3,240. It has jumped by 125% from its pandemic lows and 24% this year alone. In contrast, the S&P 500 and Nasdaq 100 indices have retreated by double digits.

Gold and Swiss franc are outpacing Bitcoin

Gold and the Swiss franc have beaten Bitcoin (BTC) safe havens as the trade war escalates. Bitcoin, often seen as the digital version of gold, has slipped from the year-to-date high of $109,300 to $83,000.

Bitcoin is often regarded as a haven because of its limited supply of 21 million coins and the elevated demand from Wall Street investors.

They have also done better than U.S. bonds, which have come under pressure in the past few weeks. On Friday, the benchmark ten-year yield rose to 4.50%, while the 30-year and 2-year yields rose to 4.85% and 3.97%, respectively.

Global risks have continued rising this week, with analysts predicting a recession will happen this year. Polymarket data places the odds of a recession this year at 60%, while BlackRock’s Larry Fink believes that the U.S. is already in one.

Mark Zandi, Moody’s chief economist, has boosted his recession odds to 60%, citing the hefty tariffs between the U.S. and China. He also noted the base US tariff of 10% on all imported goods and the 25% levy on steel, aluminum, and vehicles.

Similarly, economists at companies like Morgan Stanley, BNP Paribas, and UBS have warned that the US GDP will drop this year, and the jobless rate will rise to 5%.