The crypto community is split on stablecoins’ future, with some expecting growth and others worried about regulatory hurdles in 2025.

Stablecoins are everywhere. Wealthy businesses and VCs see them as a silver bullet for companies struggling with outdated payment systems. In countries with high inflation, like Brazil, Mexico, and Colombia, ordinary users are increasingly turning to stablecoins to save money or send funds to family members abroad. One thing is clear: stablecoins are here to stay.

And the numbers speak for themselves. According to data from blockchain forensic firm Chainalysis, stablecoins now account for approximately 70% of the share of indirect flows from Brazil’s local exchanges to global exchanges.

“Brazil’s high levels of stablecoin activity, as well as general interest in digital products and services, are drawing significant interest from major crypto players, notably Circle, which announced its official launch in Brazil in May 2024.”

Chainalysis

Nubank, the largest Brazilian digital bank in Latin America, is also chasing the trend. With over 85 million customers in Brazil and 6 million in Mexico and Colombia, the bank now offers a fixed 4% annual return to users who hold USD Coin (USDC), a stablecoin issued by Circle. Nubank says it started offering yields on stablecoins because “more than 50% of new Nubank Crypto users chose USDC as their first digital asset.”

Big venture capital firms are also betting on stablecoins, expecting them to change how small businesses handle payments. Dragonfly Capital’s managing partner, Haseeb Qureshi, says stablecoins will go beyond trading and make things like 24/7 instant settlements possible — unlike banks that close on holidays.

Citi Wealth strategists also see big potential in stablecoins, saying they “could end up reinforcing the U.S. dollar’s dominance” as market activity hit record highs with $5.5 trillion in transactions in Q1 2024.

Marc Boiron, CEO of Polygon Labs, sees huge potential in stablecoins, although he emphasizes that their growth is not just about market size.

“What’s compelling is how the fundamentals are aligning,” Boiron told crypto.news in a commentary. He pointed out that regulatory frameworks like Markets in Crypto-Assets in Europe are also providing clarity, helping traditional financial institutions enter the stablecoin space.

“Regulatory clarity is acting as a catalyst rather than a barrier. With frameworks like MiCA providing clear guidelines, traditional financial institutions and fintech companies can now approach stablecoins with greater confidence.”

Marc Boiron

Not everyone shares Boiron’s optimism about stablecoins. For Paolo Ardoino, CEO of Tether — the largest stablecoin issuer by market cap — MiCA regulations seem far-fetched, to say the least. He argues that requiring stablecoin issuers to keep at least 60% of their reserves in cash deposits could create serious risks for banks.

Ardoino compared the regulations to the incident with Circle’s USDC in 2023 when billions of dollars of USDC reserves were stuck in the collapsed Silicon Valley Bank, which failed after a bank run.

“I don’t want to endanger those 300 million people holding USDT because I have to keep the 60% in uninsured cash deposits in a European bank.”

Paolo Ardoino

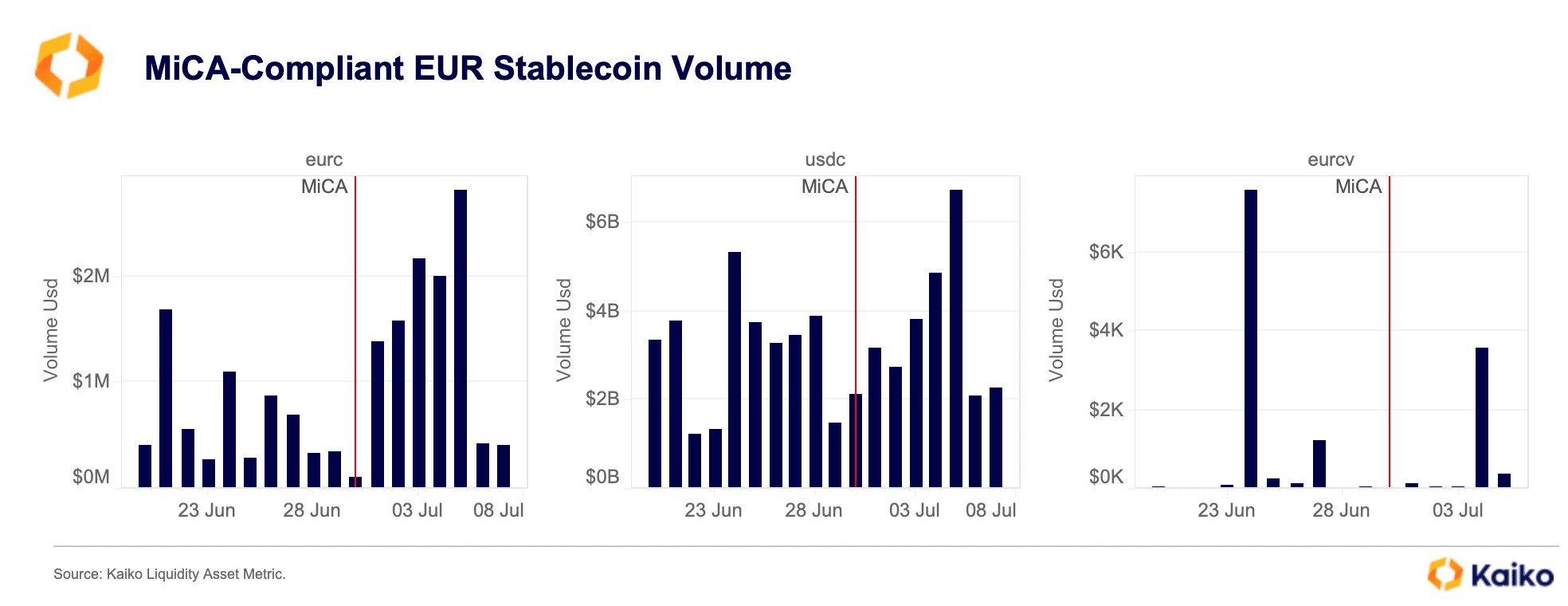

Analysts at French blockchain firm Kaiko point out that European regulations don’t affect all stablecoin issuers equally.

So far, they say only one company has benefited from the stricter rules — Circle, whose Euro-pegged stablecoin EURC and USDC have seen the biggest jump in daily trading volumes since MiCA took effect.

It might still be too early to draw conclusions. But one thing is clear — big money is eager to find a way to make the “one trillion dollar opportunity” happen. Californian venture capital firm Pantera Capital also notes that these assets now account for over 50% of blockchain transactions, up from just 3% in 2020.

What’s unclear is how or where that breakthrough will come, especially with regulations already putting pressure on even the biggest stablecoin firms.