Pump.fun’s protocol fee revenue has plummeted by 92% as activity on the platform waned in the wake of the recent controversies.

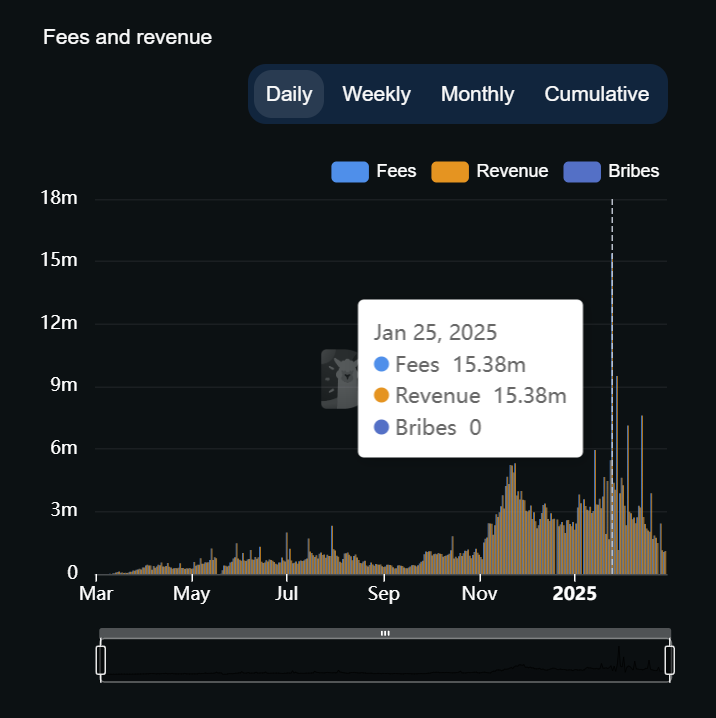

Pump.fun’s protocol fee revenue has declined by 92%, falling from its peak of $15.38 million on Jan. 25 to just $1.1 million today, according to DefiLama. This sharp decline in revenue comes as the broader activity on Pump.fun and the Solana (SOL) network has slowed in the wake of the recent events in the meme coin space, most notably the LIBRA fiasco involving Argentine President Javier Milei.

Apart from the fee revenue, token launches on Pump.fun have also seen a massive decline, dropping from over 70K on Jan. 23 to approximately 25K by Feb. 26, according to Dune data. This decline is part of the broader trend observed this year, with meme coin marketcap shedding considerably in value.

Meme coins were crashing it in 2024, reporting an annual gain of 212% for the sub-sector, according to Binance analysis. This surge was largely fueled by the popularity of Pump.fun, which saw over 5.7 million new projects launched and generated more than $400 million in revenue throughout the year.

However, 2025 has brought a shift in sentiment. Initially, meme coins were viewed as “fair launch” opportunities, where retail investors had the same chance to profit as venture capitalists and funds. However, this perception has now been challenged. The launch of the Milei coin, for example, saw its valuation hit $1 billion and quickly rise to $4 billion, revealing the scammy, manipulative nature of the meme coin sector.

Pump.fun itself has recently fallen victim to fraud. On Feb. 26, the Pump.fun X account was compromised and used to promote a fake governance token PUMP along with other fraudulent coins.