Despite almost $100M loss last week, James Wynn is back in the game, having recently sold $4.12M worth of HYPE for over $1M profit and then opened a new 945 BTC long position with 40x leverage.

According to Lookonchain, James Wynn recently unstaked 126,116 Hyperliquid (HYPE) — worth around $4.12M —and sold all of them at $32.7. Wynn originally bought these HYPE tokens on May 9 and May 12 at an average price of $24.4, which marks his profit at around $1.05M. However, this pales in comparison to the $99 million Wynn lost over the past week.

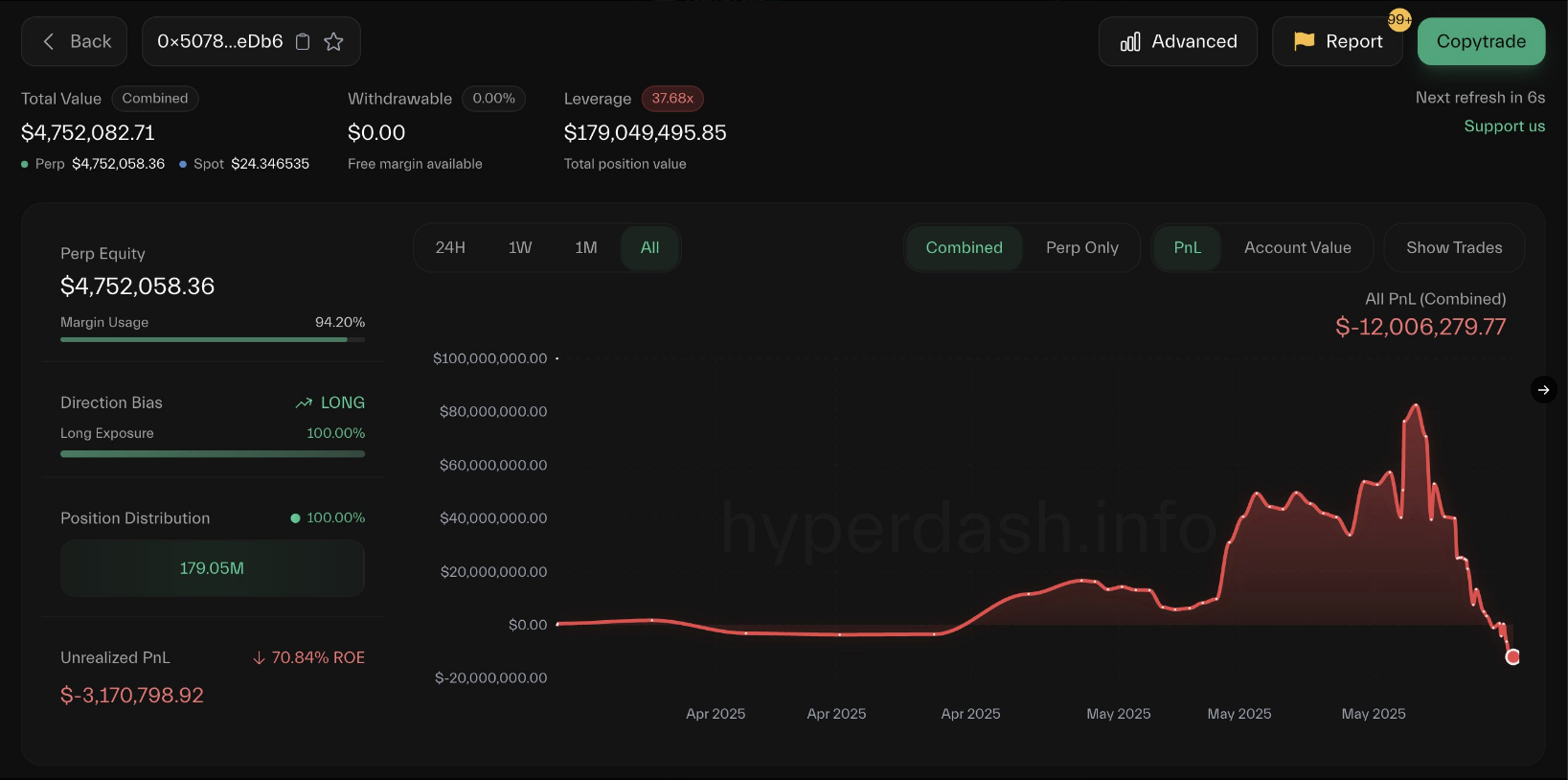

According to on-chain analytics platform Spot On Chain, the journey that resulted in almost $100 million loss began with Wynn building a series of highly leveraged positions that initially performed well.

Between March 20 and May 23, he accumulated a total profit of $83 million through a series of high-leverage trades, including a 10x long on (Pepe) PEPE with $23.8 million in unrealized gains, a 10x long on Trump (TRUMP) with $6.83 million realized, and a 5x long on Fartcoin (FARTCOIN) with $4.48 million realized. On May 22, his largest position—a $1.14 billion long on Bitcoin (BTC)—was up $39 million.

On May 24, Wynn doubled down on his BTC long, raising the position to $1.25 billion. Within hours, that trade was down $13.4 million. The next day, May 25, he reversed to a $1 billion BTC short, which resulted in a $15.87 million loss over 15 hours.

On May 30, as BTC dropped below $105K, Wynn was liquidated for 949 BTC, worth approximately $99.3 million at the time. After factoring in all positions and liquidations, Wynn’s net performance flipped from +$83 million to approximately -$12 million within seven days.

Undeterred by these losses, Wynn is back in the game, having just opened another long BTC position of 945 $BTC ($99.7M) with 40x leverage. With the initial margin at $2,177,955.53, his initial liquidation price was $104,577. However, he recently deposited another $400,000 as margin, with the new liquidation price is $104,151— less than 1% away from the current price.

Following this bet, Wynn urged his X followers to support him by buying Bitcoin. Apparently, Wynn believes that he — along with other retail traders holding highly leveraged longs on the Hyperliquid platform — are being hunted by crypto whales who are trying to liquidate them.

“The moment I entered my long the insta hunted me. There is an agenda here and I don’t know what it is. It can’t be just my long, maybe it’s because I’m a fish playing a whales game or maybe it’s because I’m bringing attention to Hyper Liquid,” he wrote.