Hong Kong-based luxury watch company, TopWin, aims to establish itself as a corporate BTC holder on par with Michael Saylor’s Strategy by rebranding itself and partnering with Sora Ventures.

According to an official press release, TopWin plans to adopt a digital asset treasury, similar to that of Michael Saylor’s company. In order to establish its Bitcoin (BTC) Treasury, TopWin will be partnering with Asian crypto fund Sora Ventures, the same firm that helped create Metaplanet’s Bitcoin reserve.

“By managing its treasury in digital assets, TopWin aims to hedge against inflation while positioning itself to benefit from the explosive growth of Web3 technologies,” wrote TopWin.

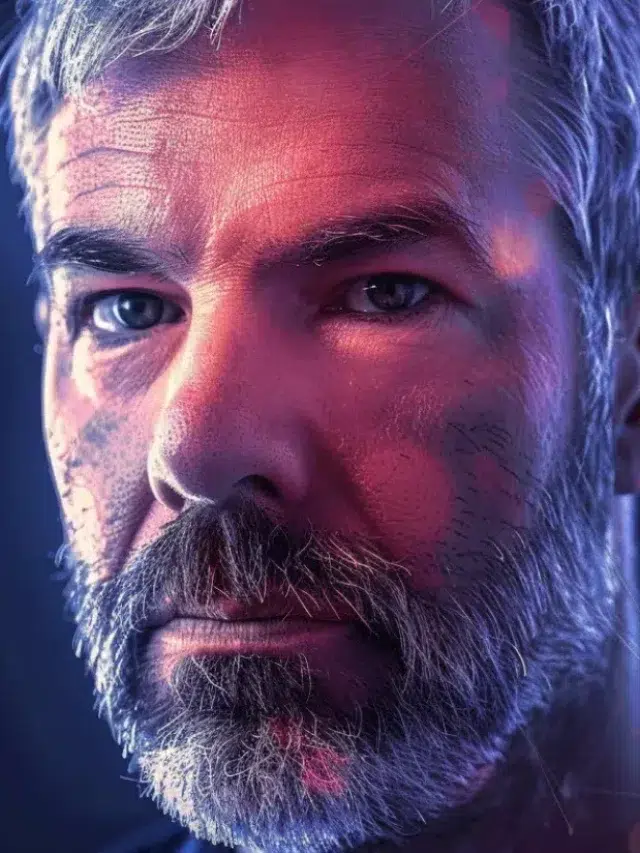

Sora Ventures has invested $150 million in the company and aims to invest in at least 10 public companies by the end of 2025. In addition, Sora Ventures’ founder and managing partner Jason Fang will be joining TopWin as a board member and co-CEO.

Alongside its foray into digital assets, TopWin also hopes to change its corporate name to “AsiaStrategy,” a direct callback to Michael Saylor’s Bitcoin-driven software company, as it aspires to establish itself as a major corporate Bitcoin holder. However, the firm’s planned name change still needs to gain shareholder approval and be registered in the Cayman Islands in order to take effect.

Formerly known as MicroStrategy, Michael Saylor’s Strategy has enjoyed an immense reputation as the largest corporate Bitcoin holder in the world. As of May 12, the firm’s total holdings stand at 568,840 BTC or worth more than $59 billion around the time of its latest purchase.

The company currently holds its Bitcoin at an average cost basis of $69,287, with a year-to-date yield of 15.5% in 2025.

Before TopWin, many traders have regarded Japanese investment firm Metaplanet as the “Asian Strategy.” The company recently surpassed the nation of El Salvador as the 11th largest public company to hold Bitcoin after it acquired 1,241 BTC, bringing its total holdings to 6,796 BTC (over $583 million).