At the recent White House crypto summit, Tyler and Cameron Winklevoss, co-founders of Gemini, reflected on their tumultuous journey from regulatory scrutiny to being seated at the nation’s highest table for cryptocurrency policy.

Crypto czar David Sacks addressed the matter to Cameron Winklevoss directly.

“I think you said something earlier that I thought was really profound,” Sacks said on Friday. “You said that a year ago, you thought it would be more likely that you’d end up in jail than at the White House.”

Cameron clarified that it was actually his twin brother Tyler who made the statement, stating: “We never thought that we’d get attacked the way we did in our backyard after trying to do the right thing for so many years and always trying to raise the bar with respect to regulations.”

“And we’ve always felt that the US should lead in Bitcoin and crypto, and it’s ours to sort of lead and win,” he continued.

‘It’s the law’

The Winklevoss twins came under scrutiny for their crypto exchange, Gemini, primarily due to issues surrounding the Gemini Earn program.

Gemini Earn allowed users to earn interest by lending their crypto assets to Genesis Global Capital, a subsidiary of Digital Currency Group (DCG). When Genesis halted withdrawals in November 2022 due to market turmoil following the FTX collapse, Gemini Earn users were unable to access approximately $900 million in funds.

The situation escalated as Gemini and Genesis were sued by the U.S. Securities and Exchange Commission (SEC) in January 2023. The SEC alleged that Gemini Earn was an unregistered offering of securities, violating securities laws. Additionally, the public feud between the Winklevoss twins and Barry Silbert, CEO of DCG, added to the scrutiny, with the twins accusing Silbert of misleading them and the public about Genesis’s financial health.

In August 2023, Gemini, Genesis, and DCG reached an agreement to recover some funds for affected users, but the situation left lasting reputational and regulatory challenges for the Winklevoss twins and Gemini.

Last year, Genesis agreed to pay a $21 million civil penalty to settle charges that it engaged in the unregistered offer and sale of securities through through crypto asset lending program.

Gary Gensler, who led the SEC at the time, said the settlement “builds on previous actions to make clear” that crypto lending platforms “need to comply” with securities laws.

“Doing so best protects investors,” Gensler added at the time. “It promotes trust in markets. It’s not optional. It’s the law.”

Today, it’s a different scenario. Mark T. Uyeda is the new acting chairman of the SEC. He was first sworn into office as a Commissioner on June 30, 2022.

Uyeda is expected to serve until the Senate votes to confirm Trump nominee Paul Atkins as the Commission’s Chair.

To say Uyeda and Atkins are pro-crypto is an understatement. Since Trump was elected, numerous lawsuits and investigations into crypto-related companies have ended. Coinbase, Kraken and Yuga Labs are just three companies to benefit from a president who not only supports cryptocurrencies, but has his very own memecoin.

Bitcoin strength matches 2022 bear market

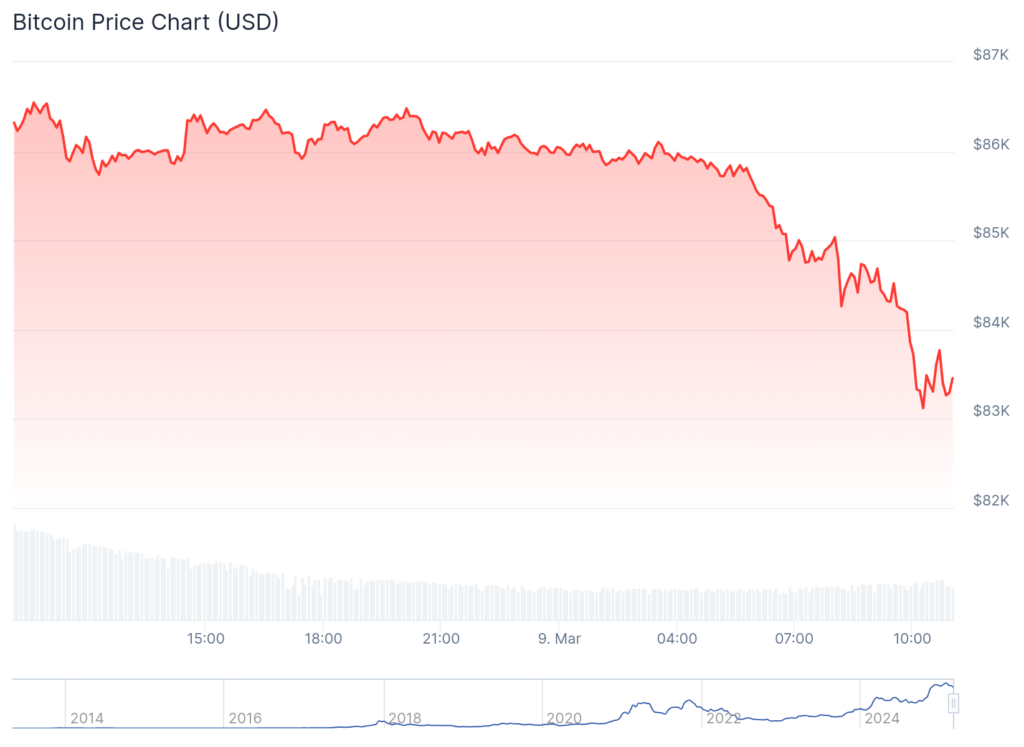

The Trump administration’s embrace of cryptocurrency comes as Bitcoin has plunged below the $85,000 level. Technical analyst Rekt Capital noted that Bitcoin’s recent drop brought its Relative Strength Index (RSI) to 23.93, matching levels seen during the 2022 bear market.

This oversold condition is usually followed by upward price movement. He also pointed out that “throughout this cycle, each visit into sub-25 RSI resulted in a trend reversal to the upside over time.”

At last check, Bitcoin (BTC) is trading in the red at $83,550.