Crypto markets were under downward pressure on Friday, Dec. 20, driven by Bitcoin’s drop below $100,000, a broad spot price dip, and a funding flush.

Cryptocurrency market prices corrected shortly after the U.S. Federal Reserve announced it would slow down rate cuts to address inflation concerns. Following the 25 basis point interest rate reduction, Bitcoin (BTC) slipped under $97,000, dragging the broader digital asset market with it, according to crypto.news price data pages.

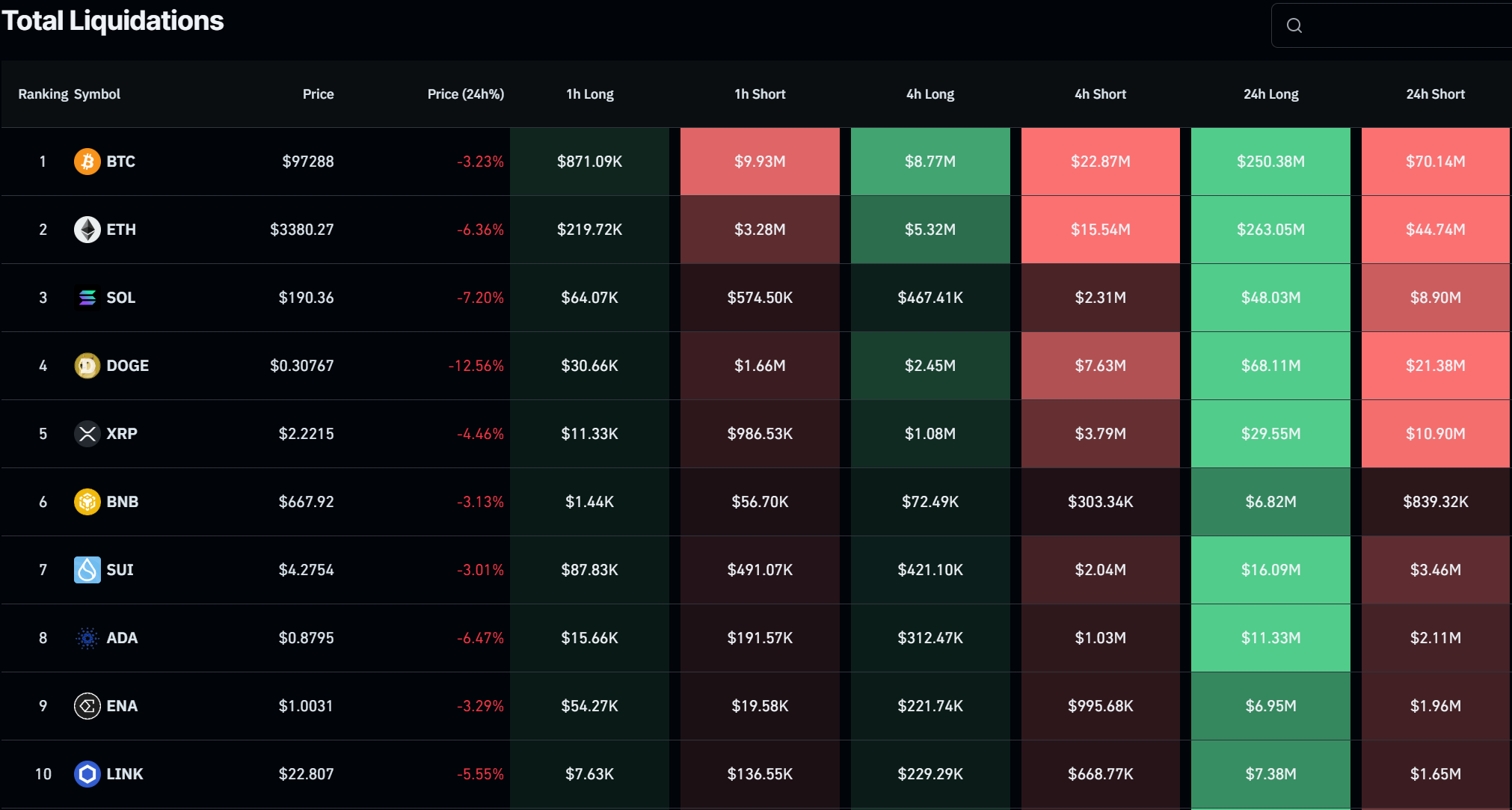

According to CoinGlass, Bitcoin’s descent triggered a $1.4 billion mass liquidation event, wiping out leveraged long positions within 24 hours. The single largest liquidated trade was a $15.8 million Ethereum (ETH) position on Binance. The trader’s identity and initial investment remain unknown.

The flush reset open interest and funding rates across top trading venues like the CME, Binance, and Bybit.

Major altcoins like Solana (SOL) and Dogecoin (DOGE) were hit hard by selling pressure, retracing the “Trump win” rally gains and posting double-digit losses over the weekly timeframe.

Despite widespread criticism of the Fed, experts suggested the market downturn was inevitable following the post-U.S. election price surge. Calls have emerged for Bitcoin to consolidate between $85,000 and $95,000 as a healthier support range.

QCP Capital stated on Telegram that hyper-bullish sentiment in the market ultimately triggered the correction. The total crypto market, which was approaching $4 trillion for the first time, fell to approximately $3.4 trillion at press time, down 7.6% in the past day.

While it it easy to blame the selloff on the Fed’s hawkish cut, we believe the root cause of the morning’s crash to be market’s overly bullish positioning. Since the election, risk assets have enjoyed an impressive one-sided run, leaving the market extremely vulnerable to any shocks.

QCP Capital