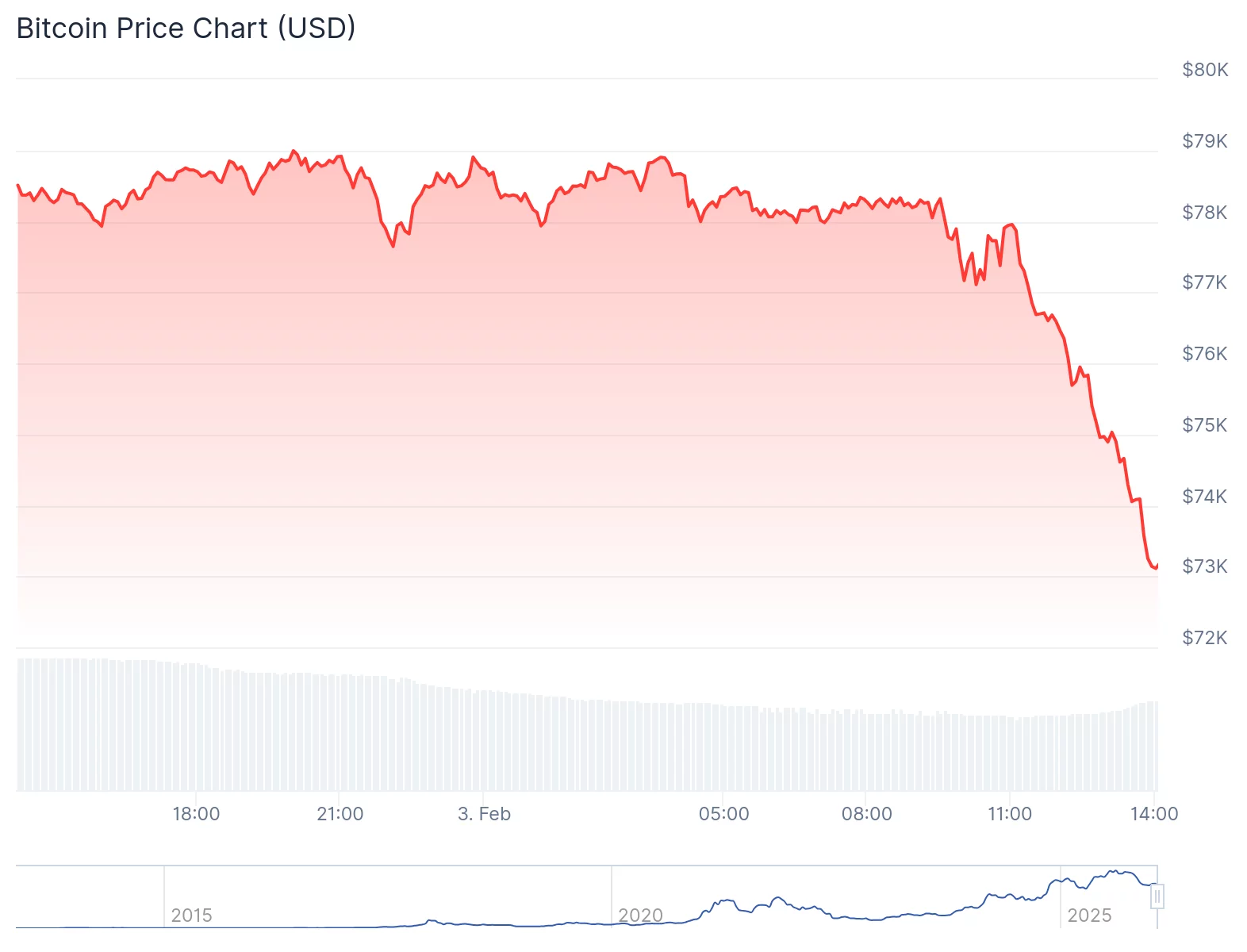

Bitcoin dropped to fresh lows around $73,000 on Tuesday, its lowest point since early 2025, and is now down more than 15% year-to-date.

Summary

- Bitcoin has continued its downward trend since its October 2025 record high, partly triggered by President Trump’s tariff comments.

- Despite supportive policies from a pro-crypto White House and strong institutional interest, Bitcoin’s market has been under pressure.

- Bitcoin still trading more like a high-risk asset than “digital gold.”

Gold, meanwhile, posted its largest single-day gain since November 2008, recovering from a sharp decline earlier in the week, while silver surged by as much as 15% after a dramatic 27% crash on Friday.

Both metals’ sell-offs were triggered by President Trump’s Fed Chair nomination, Kevin Warsh, which tightened expectations on rate cuts and balance-sheet policy.

Meanwhile, Bitcoin’s (BTC) drop, over 6% on the day, following a broader crypto slump, with Ethereum falling to $2,100.

The $65,000 level is now emerging as a focal point for market participants. This area represents not just a psychological round number, but a dense cluster of technical confluences that historically attract demand.

Bulls need to reclaim the $87,551 level to reverse the bearish trend, though that seems unlikely in the current market environment. Immediate resistance sits at $80,000 and $84,000.

Massive Selloffs

The cryptocurrency’s drop follows a turbulent year, marked by a steep decline from its October 2025 peak, when it hit a record high.

A series of market-moving events, including President Trump’s tariff comments, triggered a massive selloff that wiped out $19 billion in leveraged bets, with Bitcoin tumbling over 40% since then, according to Bloomberg.

Despite supportive policies from Trump, who pledged to turn the U.S. into the world’s “crypto capital,” Bitcoin has struggled to regain momentum, now testing critical support levels below $75,000.