Bitcoin remained resilient during the latest market sell-off, while altcoins faced estimated liquidations of $8 billion to $10 billion, with funding rates turning deeply negative, a survey claims.

A sharp spike in volatility shook the crypto market, erasing billions in open interest, with Bybit and Block Scholes reporting that Bitcoin (BTC) stayed steady while altcoins took the biggest hit.

In a research report shared with crypto.news, Bybit stated that Bitcoin “outperformed relative to the wider crypto market,” adding that its perpetual swaps fared better as well. In contrast, the Ethereum (ETH) options market experienced a sharp spike in short-term volatility, surging above 140%, its highest level in over three months.

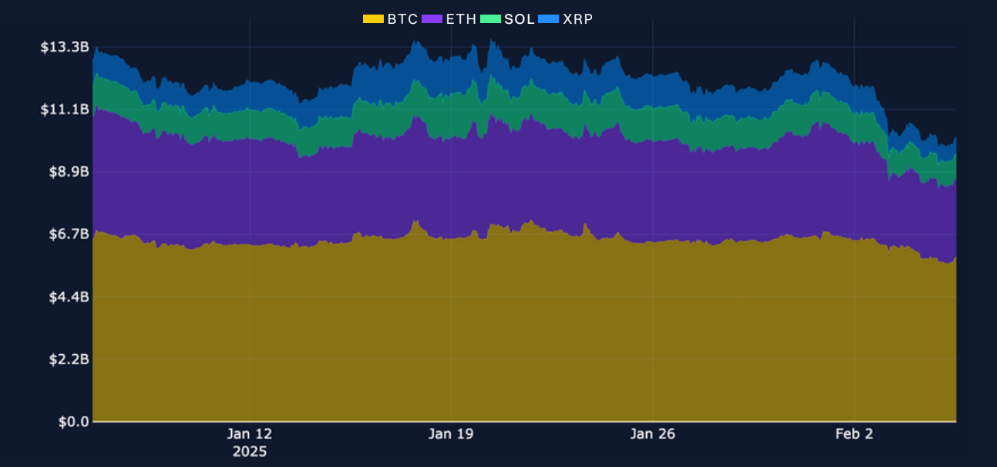

Liquidations were brutal. As crypto.news earlier reported, Bybit CEO Ben Zhou estimates that the true notional value of liquidated positions could have been “at least $8 billion to $10 billion.” Across BTC, ETH, XRP (XRP), and Solana (SOL)’s perpetual swaps, more than $3.1 billion in open interest vanished after a late-Friday high.

Funding rates drop for altcoins

Funding rates reflected the bearish shift. Altcoins saw deeper negative funding rates in the days following the crash, while BTC remained relatively stable, the report states. Open interest levels plummeted across major tokens, with one key exception—Bitcoin’s options market. Unlike perpetuals, Bitcoin options did not experience a major liquidation event, and its term structure inversion quickly resolved, Bybit noted.

Despite the market turmoil, trading volume surged, with over $31.1 billion in perpetual swaps traded on Feb. 2, marking the highest daily volume in over a month. For Bitcoin, short-term options volatility eased after an early-week spike, suggesting a return to stability, at least for now.