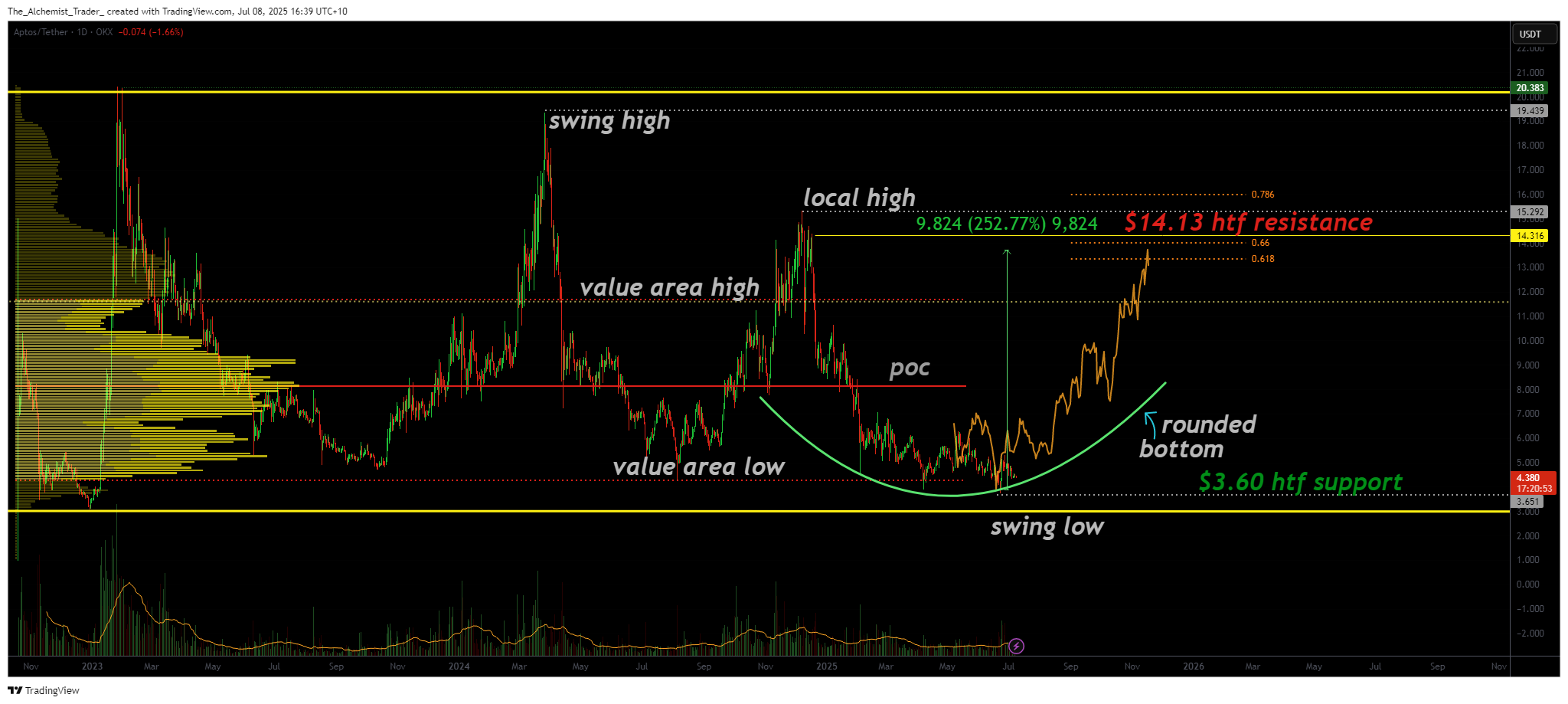

Aptos is trading at the bottom of a multi-month range. With a potential rounded bottom forming and confluence at $14, the current support zone offers a high-reward setup with 250% upside.

Aptos (APT) is currently positioned in what can only be described as a “Max Opportunity” zone—the lower boundary of a high time frame trading range that has held firm for months. Historically, this zone has served as a launchpad for rallies toward the range high and now presents a compelling long setup for both swing traders and long-term investors. The price structure hints at accumulation, and attention is now focused on whether bullish expansion can emerge from this technically significant area.

Key technical points

- Major Support at $3.65: Long-term range low aligning with the value area low.

- Rounded Bottom Structure Forming: Accumulation pattern supports a reversal narrative.

- Upside Target at $14: 0.618 Fibonacci and high time frame resistance aligned, representing a potential 250% rally.

Aptos is trading near $3.65, the macro range low of a prolonged consolidation phase. Historical interactions with this level have triggered sharp bullish reversals, including a prior rally that extended to the value area high. This reinforces the zone’s significance as both a trade location and structural support.

Current price action suggests a rounded bottom is developing—a classic accumulation pattern that often forms at market lows. Rounded bottoms signal a shift in control from sellers to buyers, as selling pressure fades and demand gradually builds. The longer Aptos consolidates at this level without breaking down, the greater the likelihood of a bullish breakout.

The support zone also aligns with the value area low on the volume profile, indicating high historical trading activity and strong demand. This confluence strengthens the case for this area as a durable floor unless meaningful selling emerges, which has not materialized.

If Aptos confirms this rounded bottom formation and begins to rotate higher, the next key target lies around $14. This level represents the 0.618 Fibonacci retracement from the previous move, a prior swing high, and a major high time frame resistance zone. A move from $3.65 to $14 would mark an approximate 250% rally, offering a compelling risk-to-reward scenario.

What to expect in the coming price action

As long as Aptos holds above the $3.65 value area low, the probability of a bullish breakout remains elevated. Traders should watch for confirmation of the rounded bottom pattern and monitor volume activity as APT attempts a rotation toward the $14 level in the coming weeks.