XRP declined 7% since Monday, during a big week for crypto. President Donald Trump’s crypto czar, David Sacks, held a press conference and called it “a golden age in digital assets.” Sacks remains focused on laying out clearer regulation for stablecoins and Ripple’s RLUSD could benefit from the development.

XRP (XRP) price is typically influenced by the U.S. Securities & Exchange Commission’s lawsuit against the payment firm Ripple, the adoption and partnerships of RLUSD stablecoin and the XRPLedger’s developments.

XRP could gain from Trump’s Crypto Czar’s first order of business

U.S. Crypto Czar David Sacks has marked stablecoin legislation as his first priority, according to his first presser held on Tuesday this week, reports CNBC. As Sacks works towards ushering in a golden age in digital assets and cryptocurrencies, XRP holders could gain from the developments, and the altcoin could begin its recovery.

XRP wiped out nearly 7% of its value from Monday’s open of $2.5801 down to $2.4060. Sacks has set a timeline of six months for stablecoin regulation and earmarked it as a top agenda item.

Ripple’s RLUSD recently announced a slew of partnerships with crypto exchanges and institutions. The stablecoin RLUSD is now available on 14 exchanges, including Archax, Bitso, Bitstamp, Bullish, B2C2, Coinmena, Independent Reserve, JST Digital, Keyrock, MB, Moonpay, Revolut, Uphold and Zero Hash.

Ripple’s stablecoin can be traded, used for payments and within financial applications through the 14 exchange platforms.

Ripple lawsuit could end, CTO has optimistic outlook

The SEC’s lawsuit against Ripple in 2020 led to some partial victories for the payment firm, per Judge Analisa Torres’ rulings. From ruling secondary market sales of XRP as “non-security” to the application of the Howey Test, Ripple’s victories have catalyzed gains in XRP price.

The positive developments that could lead to an end of the lawsuit and further victories for Ripple include two key updates:

Ripple’s Chief Technology Officer is optimistic that the changes could pave the way for positive regulation and expressed his bullish sentiment in a tweet on X.

Ripple’s on-chain metrics support bullish thesis

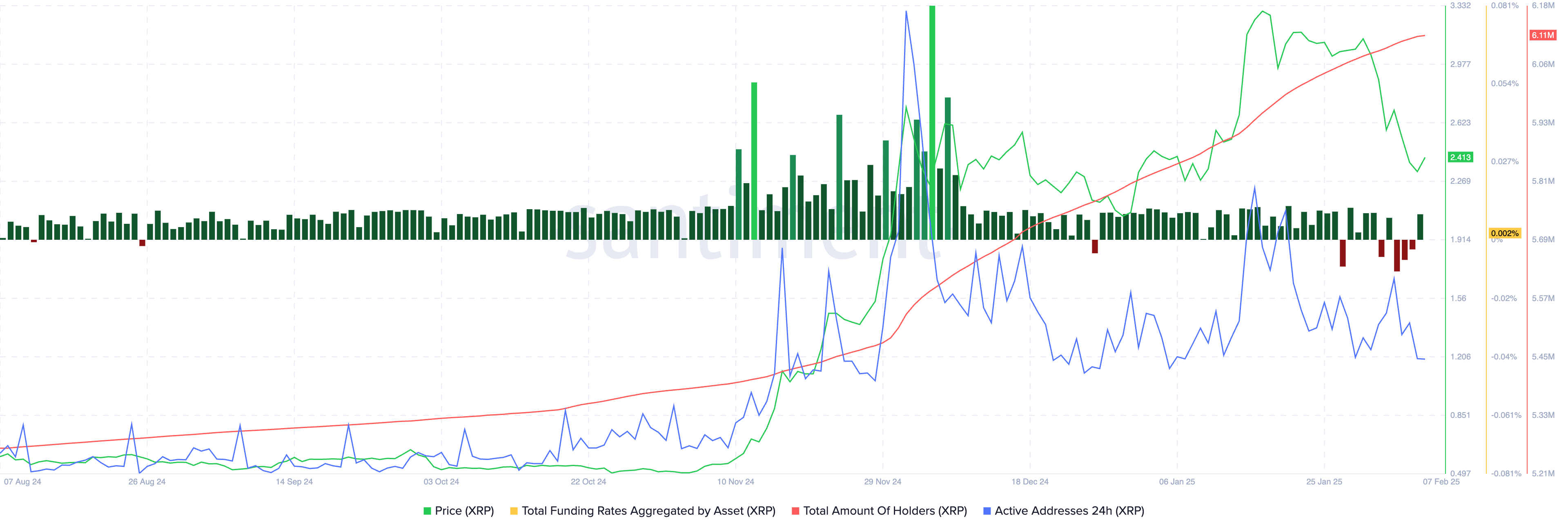

Ripple on-chain metrics, like total funding rates aggregated by XRP across exchanges, support a recovery in the coming week. The funding rate turned positive on Friday after three consecutive days of negative funding rates this week.

Typically, a negative funding rate is associated with a bearish sentiment among derivatives traders. The count of active addresses (24-hour timeframe) remains above the 2024 average and the total number of XRP holders has shown a steady increase throughout the second half of 2024 and 2025.

The total value of assets locked on the XRPLedger held steady above $80 million, according to DeFiLlama data. TVL is an indicator of investor confidence and relevance of a blockchain, and contributes to a bullish thesis for the native token of the chain, XRP.

Technical analysis and XRP price target

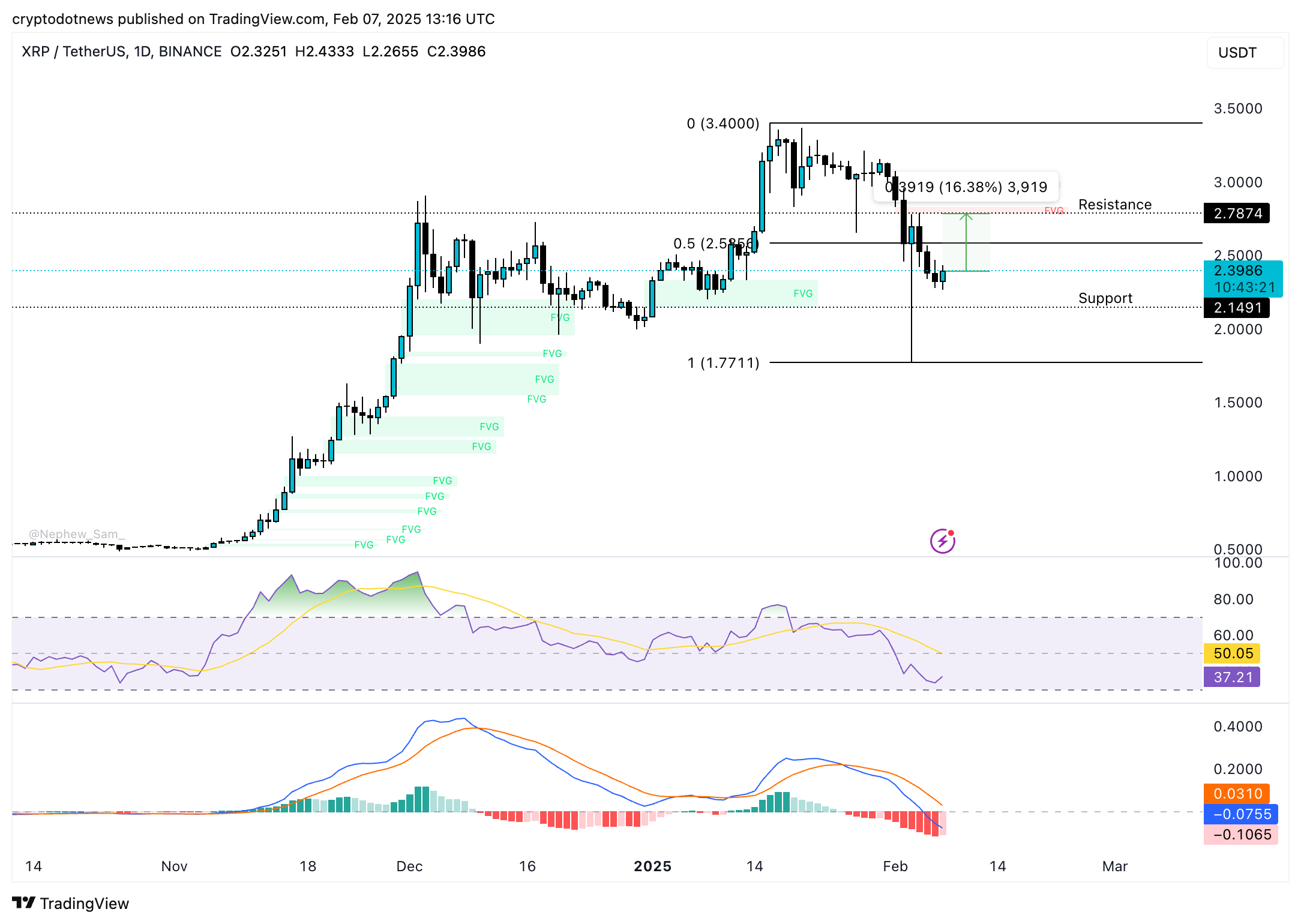

XRP started its downward trend on January 16. The altcoin trades at $2.3986 at the time of writing. Technical indicator on the daily timeframe, RSI points at a bullish thesis for XRP. RSI reads 37 and is sloping upwards.

MACD on the XRP/USDT price chart shows an underlying negative momentum in XRP price trend, however the red histogram bars have reduced intensity and are shorter, meaning traders need to keep eyes peeled for a reversal.

XRP could face resistance at the lower boundary of the Fair Value Gap (FVG) between $2.7874 and $2.8281. This marks a 16% rally in XRP price. The altcoin could find support at $2.1491, the December 31 high for XRP.

XRP Bitcoin correlation and strategic consideration

The three-month correlation between XRP and Bitcoin (BTC) is 0.83, according to Macroaxis data. A relatively high correlation with Bitcoin implies XRP price moves in response to Bitcoin and a crash in BTC drags down the altcoin, as seen earlier this week.

Traders need to be mindful of the correlation and watch the Bitcoin price chart closely to anticipate volatility in XRP price.

The long/short ratio for XRP is greater than 1 on key exchanges like Binance and OKX. Derivatives traders maintain a bullish stance on the altcoin.

Options open interest notes no significant change in the last 24 hours and hover above $3.6 billion, according to Coinglass data.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.