XDC, the native token of the layer-1 blockchain, surged to a 39-month high on Jan. 15 after breaking a key resistance level fueled by a new partnership.

XDC Network (XDC) soared 22% to $0.1231 over the past day, becoming the top gainer among the 100 largest crypto assets per data from CoinGecko. Its market cap stood at over $1.7 billion as of press time.

The altcoin’s price rally was accompanied by a surge in trading volume and open interest in the futures market. Notably, the asset’s trading volume was up 44% over the past day, hovering over $84 million, while its open interest doubled over the same timeframe to $4.62 million.

XDC rallied after the project announced its partnership with the account abstraction platform PillarX, which will integrate XDC into its ecosystem. This would enable the platform’s users to incorporate XDC into their Web3 activities while benefiting from advanced features like enhanced transaction efficiency and usability.

The partnership will also strengthen the XDC Network’s foothold in the RWA tokenization market by enhancing its accessibility and utility for tokenizing real-world assets through seamless Web3 integration. RWA tokenization allows users to convert physical assets, like real estate, into digital tokens that can be traded on blockchain networks.

The XDC Network has previously partnered with Archax, a digital securities exchange and custodian regulated by the Financial Conduct Authority, to promote the adoption of tokenized real-world assets. As such, the project holds the second-largest position in the RWA market, trailing behind only Mantra, which has a market cap of over $3.6 billion.

Another factor that has renewed investor confidence in the project is the growth of the XDC Network DeFi ecosystem over the past months. According to DefiLlama, its total value locked in the DeFi ecosystem has surged from $8.5 million at the beginning of November to an all-time high of $31.23 million, as seen on Jan. 15.

Further, the altcoin’s rally was partly supported by Bitcoin’s march back toward $100k as the broader crypto market recovered following cooler-than-expected inflation data from the Bureau of Labor Statistics. The Crypto Fear and Greed Index has also shifted back to “Greed” from the neutral levels seen last week, with a reading of 70 at press time, indicating a risk-on sentiment in the market.

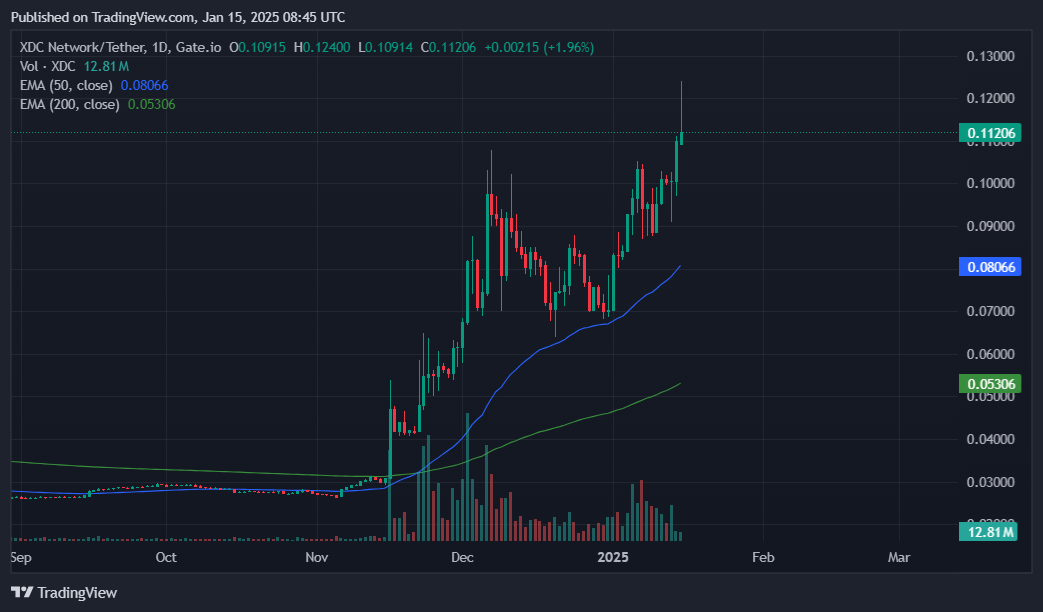

XDC price action

On the 1-day XDC/USDT chart, the Moving Average Convergence Divergence indicator suggests that the rally could continue with both MACD and the signal line pointing upwards. This is confirmed by the Supertrend indicator, with the Supertrend line moving below the line to support the bullish outlook.

The altcoin is also trading above the 50-day and 200-day Moving Averages which means the buying pressure is still up with bulls targeting higher prices, potentially aiming for a new all-time high of $0.19, around 39% higher than the current price of $0.1131.

However, the XDC rally could face a pullback before continuing its rally as its price approaches the upper Bollinger Band and the Relative Strength Index nears overbought levels.

Another potential driver that could hinder a bullish continuation is increased selling activity observed from retail traders. Over the past day, XDC traders have moved $3.06 million worth of tokens into exchanges, while $2.57 million was withdrawn per CoinGlass data.

Increased amounts of cryptocurrency being sent to exchanges is typically a sign that investors could be preparing to sell off their holdings either to cash in profits or rotate funds into a different asset.