Ethereum spot ETFs recorded $10.26 million in net inflows on February 13, breaking a two-day outflow streak that saw $242.28 million in redemptions.

Summary

- Ethereum ETFs added $10M as ETH price reclaimed $2,000.

- Bitcoin ETFs saw modest $15M inflows after prior outflows.

- Weekly ETH ETF flows remain negative despite rebound.

Grayscale’s mini ETH trust led flows with $14.51 million, followed by VanEck’s ETHV at $3.00 million and Fidelity’s FETH at $2.04 million.

Ethereum (ETH) price gained 5.8% over 24 hours to reclaim the $2,000 level, trading in a range of $1,926.66 to $2,067.44.

The recovery follows sharp declines across longer timeframes: down 1.2% over seven days, 23.7% over 14 days, 37.5% over 30 days, and 24.4% over one year.

Weekly Ethereum outflows persist at $161 million

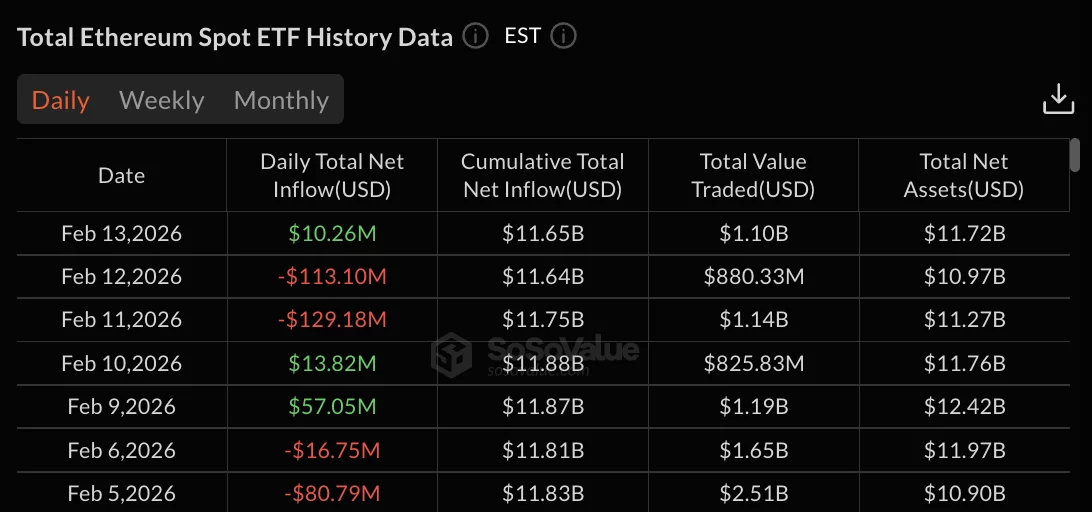

Ethereum ETFs recorded $161.15 million in weekly net outflows for the period ending February 13 despite the final day’s positive flow.

February 11 posted the week’s largest single-day withdrawal at $129.18 million, followed by February 12’s $113.10 million in redemptions.

February 9-10 briefly interrupted selling with $70.87 million in combined inflows. February 9 saw $57.05 million in positive flows while February 10 added $13.82 million.

The week ending February 6 posted $165.82 million in outflows, while the week ending January 30 recorded $326.93 million in redemptions.

The week ending January 23 marked the peak with $611.17 million in withdrawals as Ethereum fell from above $3,000 to below $2,000.

Total value traded reached $1.10 billion on February 13, down from $880.33 million the previous day.

Bitcoin posts modest $15 million inflow with mixed fund flows

Bitcoin spot ETFs recorded $15.20 million in net inflows on February 13, led by Fidelity’s FBTC with $11.99 million.

Grayscale’s mini BTC trust added $6.99 million while VanEck’s HODL contributed $1.95 million and WisdomTree’s BTCW posted $3.64 million.

BlackRock’s IBIT recorded $9.36 million in outflows and was its third withdrawal in four trading days.

February 11-12 saw Bitcoin ETFs post $686.67 million in combined outflows before February 13’s reversal.

Ethereum’s 5.8% daily gain allowed it to reclaim the $2,000 level after dipping below $1,930 earlier in the session.