Ethereum spot ETFs recorded $55.71 million in net inflows on November 21, breaking an eight-day outflow streak.

Summary

- Ethereum ETFs ended an eight-day outflow streak with $55.71M in net inflows.

- Fidelity’s FETH drove recovery with $95.4M inflows while BlackRock saw $53.7M out.

- ETH price stayed below $2,800, down 12.9% weekly and 28.9% over the past month.

Fidelity’s FETH led the inflows with $95.40 million, while BlackRock’s ETHA posted $53.68 million in outflows, partially offsetting the gains.

The ETF inflows failed to lift the Ethereum (ETH) price above $2,800. ETH has dropped 12.9% over the past seven days and 28.9% over the past 30 days. The token has also fallen 18.4% over the past year.

Fidelity drives ETF recovery after $1.3B in outflows

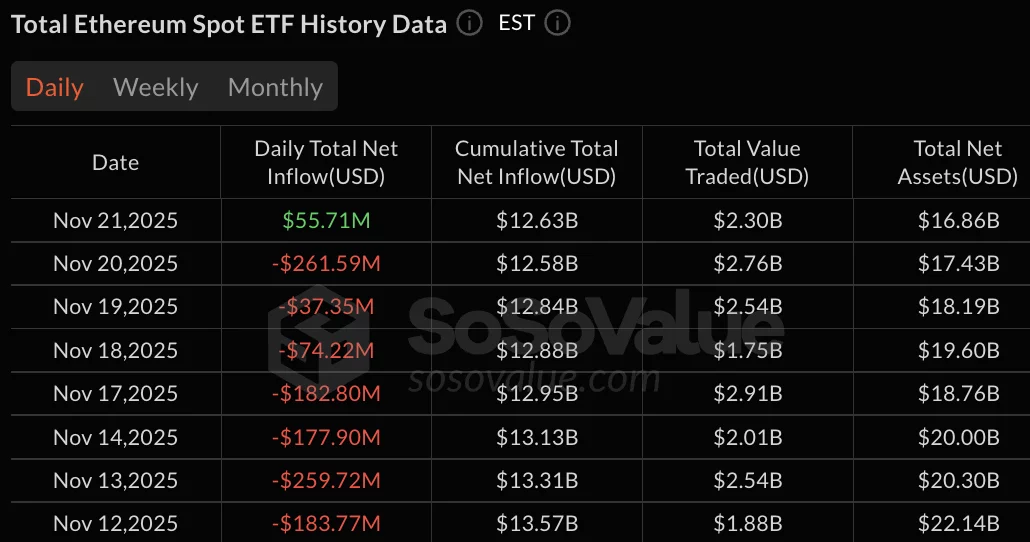

Ethereum ETFs bled $1.3 billion between November 11 and November 20. November 20 recorded the largest single-day withdrawal at $261.59 million, followed by $259.72 million on November 13 and $182.80 million on November 17.

BlackRock’s ETHA continued seeing redemptions on November 21 with $53.68 million in outflows. The fund maintains cumulative net inflows of $12.89 billion.

Fidelity’s FETH attracted $95.40 million on November 21. Cumulative net inflows for FETH reached $2.54 billion.

Grayscale’s ETH mini trust recorded $7.73 million in inflows, bringing its total to $1.42 billion. Bitwise’s ETHW saw $6.26 million in inflows, with cumulative assets hitting $399.30 million.

Grayscale’s ETHE, VanEck’s ETHV, Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH all posted zero flow activity on November 21.

Total net assets under management for ETH ETFs stood at $16.86 billion as of November 21.

Cumulative total net inflow across all ETH ETFs reached $12.63 billion. Total value traded hit $2.30 billion on November 21, down from $2.76 billion the previous day.

ETH price struggles amid overall market weakness

Ethereum price has underperformed Bitcoin (BTC) and other major cryptocurrencies over the past month. The 28.9% decline over 30 days contrasts with Bitcoin’s modest pullback during the same period.

The ETF inflows on November 21 came after eight consecutive days of redemptions totaling over $1.3 billion. The outflow streak began on November 11 with $107.18 million in withdrawals.

November 17 and November 20 recorded the steepest sell-offs. The $182.80 million outflow on November 17 was followed by $261.59 million in redemptions on November 20.

ETH failed to reclaim the $2,800 level following the ETF inflows. The token’s 14-day performance shows a 19.4% drop, suggesting selling pressure has risen in recent weeks.