The very first step towards crypto trading is choosing the correct crypto trading platform. Currently, the market is flooded with various exchanges, some of them are not legal while some are utter scams that look attractive.

Etoro,gemini and Bydfi are three of the most popular and trustworthy crypto trading platforms in current time. In this article, we will compare these three crypto trading platforms based on various characteristics ranging from fee,security etc.

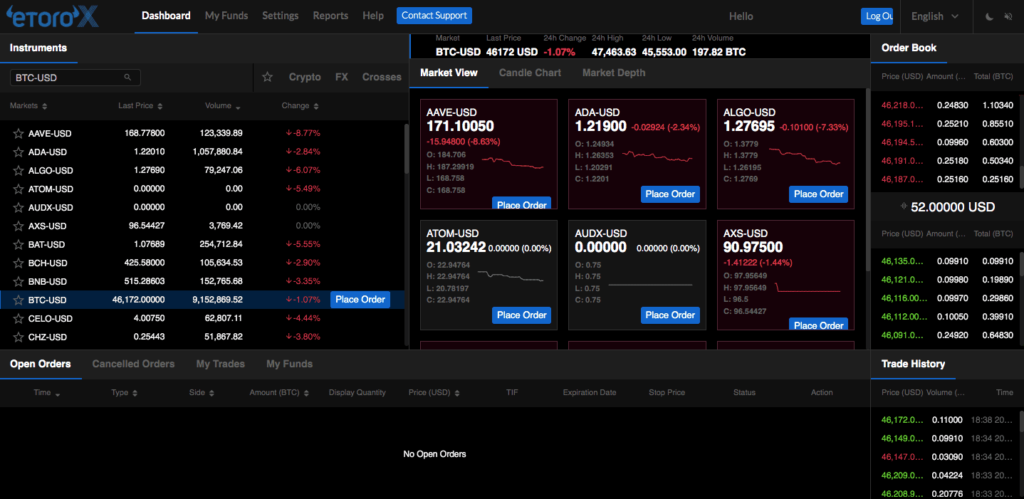

eToro

Overview:

eToro is a well known trading platform launched in the year 2007. eToro is a trading company that focuses on cryptocurrency trading, and boasts over 8 million users worldwide. Further, the platform lets you trade and invest in top financial instruments, including a wide selection of stocks.

eToro also has a social trading revolution program where you can connect with traders worldwide and discuss your trades. This technology helps you to copy their trading portfolio performance automatically.

Key Features:

- Social Trading: eToro’s standout feature is its CopyTrader functionality, allowing users to replicate the trades of successful investors.

- Diverse Asset Portfolio: Access to over 2,000 financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, and commodities.

- User Interaction: Traders can interact, share insights, and follow strategies, fostering a social community.

The registration process on eToro involves providing an email address, verification, and setting a password. Users can opt for a demo account to familiarize themselves with the platform.

Deposit Methods

eToro supports various funding methods, including credit cards, bank transfers, PayPal, Neteller, and Skrill. The minimum deposit is $50.

Trading Features and Fees

eToro’s key features include one-click trading, a vast range of financial assets, and social trading functionalities. It charges a spread on trades, and overnight fees apply for CFD positions.

Security

eToro implements SSL encryption for data security. It is regulated by FCA, CySEC, MiFID, and ASIC, ensuring compliance with industry standards.

Pros:

- Social trading and copy trading features.

- User-friendly interface.

- Regulated and secure.

Cons:

- Spreads instead of traditional transaction fees.

Also Read, Best eToro Alternatives

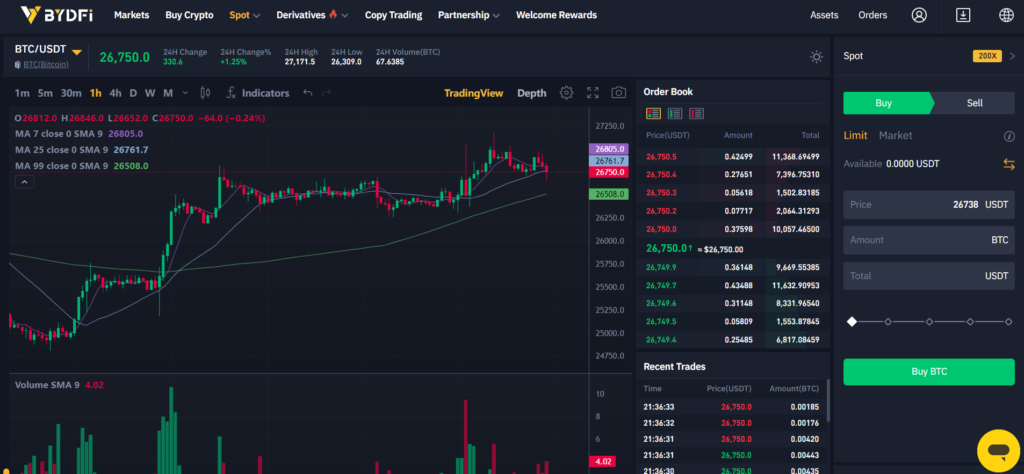

BYDFI

Overview:

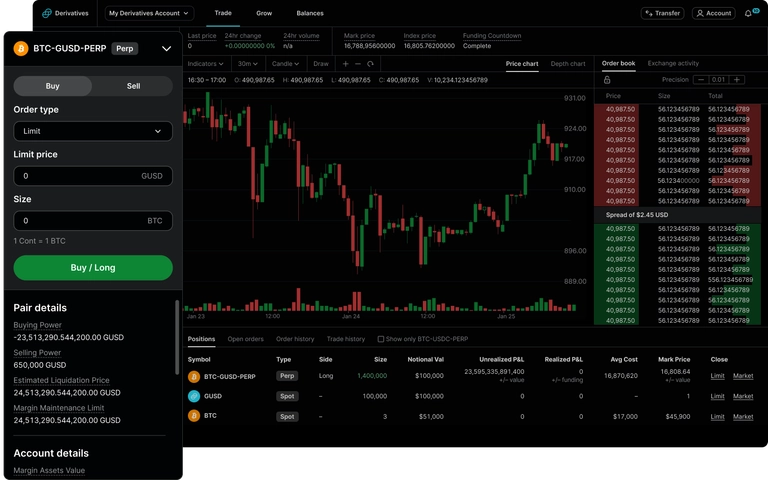

BYDFI, formerly known as Bityard is a crypto derivatives trading platform offering spot trading, CFDs, and copy trading. It has positioned itself as a one-stop trading solution. It is headquartered in Singapore and has been operational since 2019. Bydfi covers over 150 countries.

Users can trade on BYDFI in numerous cryptocurrencies with leverage up to 125x on crypto and 200x on derivatives. Furthermore, read out guide to BYDFI margin trading to understand things better. It also has a lite contract trading system.

Key Features:

- Spot and Derivatives Trading: BYDFI provides spot trading, CFDs, and perpetuals, futures, giving users diverse trading options.

- Copy Trading: Novice traders can copy the strategies of experienced investors, facilitating learning and potential profit.

- Fiat Deposits: Supports 59 fiat currencies for deposits, enhancing accessibility.

Account Registration

BYDFI’s registration requires an email or phone number, verification, password setup, and an optional invitation code. The platform offers a demo account for practice.

Deposit Methods

BYDFI allows deposits in 59 fiat currencies through electronic fund transfers, credit/debit cards, and cash deposits (for specific locations). KYC verification is required for fiat deposits.

Trading Features and Fees

BYDFI offers spot trading, CFDs, copy trading, and perpetual futures. Fees vary for different products, with trading commissions, overnight fees, and leverage-related charges.

Security

BYDFI prioritizes user security through email confirmations, a strict verification process, and offline storage for assets. Bydfi is regulated by authorities in Singapore, USA, and Estonia.

Pros:

- Lot of trading Options.

- Extensive and easy to use charting tools.

- Affiliate and Referral program.

Cons:

- Limited withdrawal options.

You can read our full Bydfi Review here.

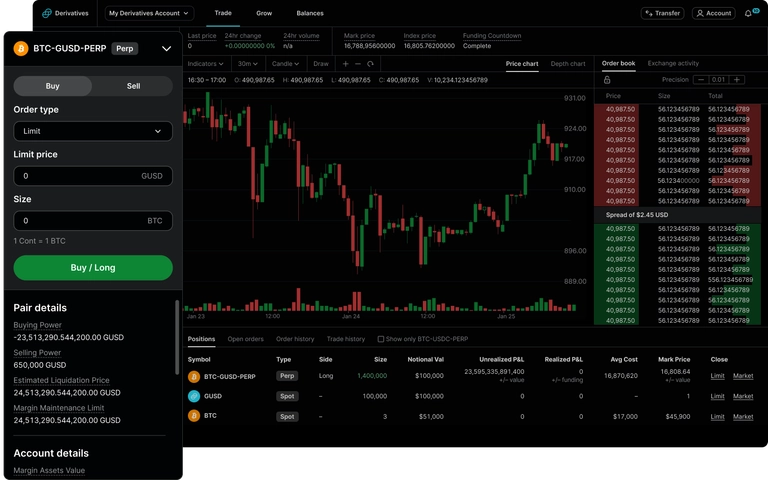

Gemini

Overview:

Lastly we have Gemini which was founded in 2014 by the Winklevoss Twins. Gemini is a New York-based cryptocurrency exchange. It is known for its commitment to security and regulatory compliance.

It offers many crypto trading options like Gemini earn, which is a crypto lending program. They also offer a product, “Active Traders,” for advance level trading and Gemini trading for beginner level traders.

Key Features:

- Security Focus: Gemini places a high emphasis on security, utilizing offline cold storage for the majority of user assets.

- User-Friendly Interface: Suitable for both beginners and advanced traders, Gemini offers an intuitive platform with additional features for professional trading.

- Gemini Earn: Users can earn interest on their crypto holdings through the Gemini Earn feature.

Account Registration

Gemini’s registration involves providing necessary details, phone number verification, and address entry. The verification process is mandatory for trading.

Deposit Methods

Gemini supports bank transfers, debit cards, and deposits via third-party services like Plaid. Debit card verification allows instant crypto purchases.

Trading Features and Fees

Gemini provides a user-friendly interface, ActiveTrader for advanced trading, and Gemini Earn for passive income. Fee structures include trading fees, withdrawal fees, and custody fees.

Security

Gemini places a strong emphasis on security, utilizing offline cold storage for the majority of user assets. Two-Factor Authentication (2FA) enhances account security.

Pros:

- Secure and regulated platform.

- Different products for different traders.

- Gemini Earn feature for earning passive income.

Cons:

- Relatively higher fees compared to other platforms.

Conclusion

Based on all the features and functionalities, we can say that all it all comes down to individual preference and experience level. eToro excels in social trading, BYDFI offers a comprehensive one-stop trading solution and Gemini focuses on security and user-friendliness. Crypto traders can consider their specific needs, such as asset variety, fees, and security features, before selecting the most suitable platform.

We recommend Bydfi as it is best for all types of traders and offers all necessary functions along with proper security and customer support. Remember, it is not a trading or financial advice, you should consult your financial advisor before taking any finance related information.

Which Crypto trading platform is best for beginners?

BYDFI caters to both beginners and advanced traders and it has an easy navigation plus interactive interface, so it is best for beginners.

Can I deposit fiat currency on all three platforms?

Yes, eToro, BYDFI, and Gemini support fiat currency deposits through various methods.

Does BYDFI support margin trading, and what are the associated risks?

Yes, BYDFI supports margin trading with leverage. It’s important to note that while leverage can amplify profits, it also increases the risk of losses. Traders should have a clear understanding of the risks involved in margin trading.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

eToro is a multi-asset investment platform. The value of your investmen ts may go up or down. Your capital is at risk.