Rexas Finance stunned the market with a 325% gain in a matter of hours. But as price enters a corrective phase, traders are now eyeing key levels to determine what’s next.

Rexas Finance (RXS) has delivered one of the most eye-catching moves across the market with an explosive 325% rally. The move was impulsive, aggressive, and fueled by momentum, but the real question is whether this was a blow-off top or simply a launchpad for higher prices. While volume has begun to decline, the market structure hasn’t yet shifted bearish, suggesting this correction may be part of a broader bullish continuation.

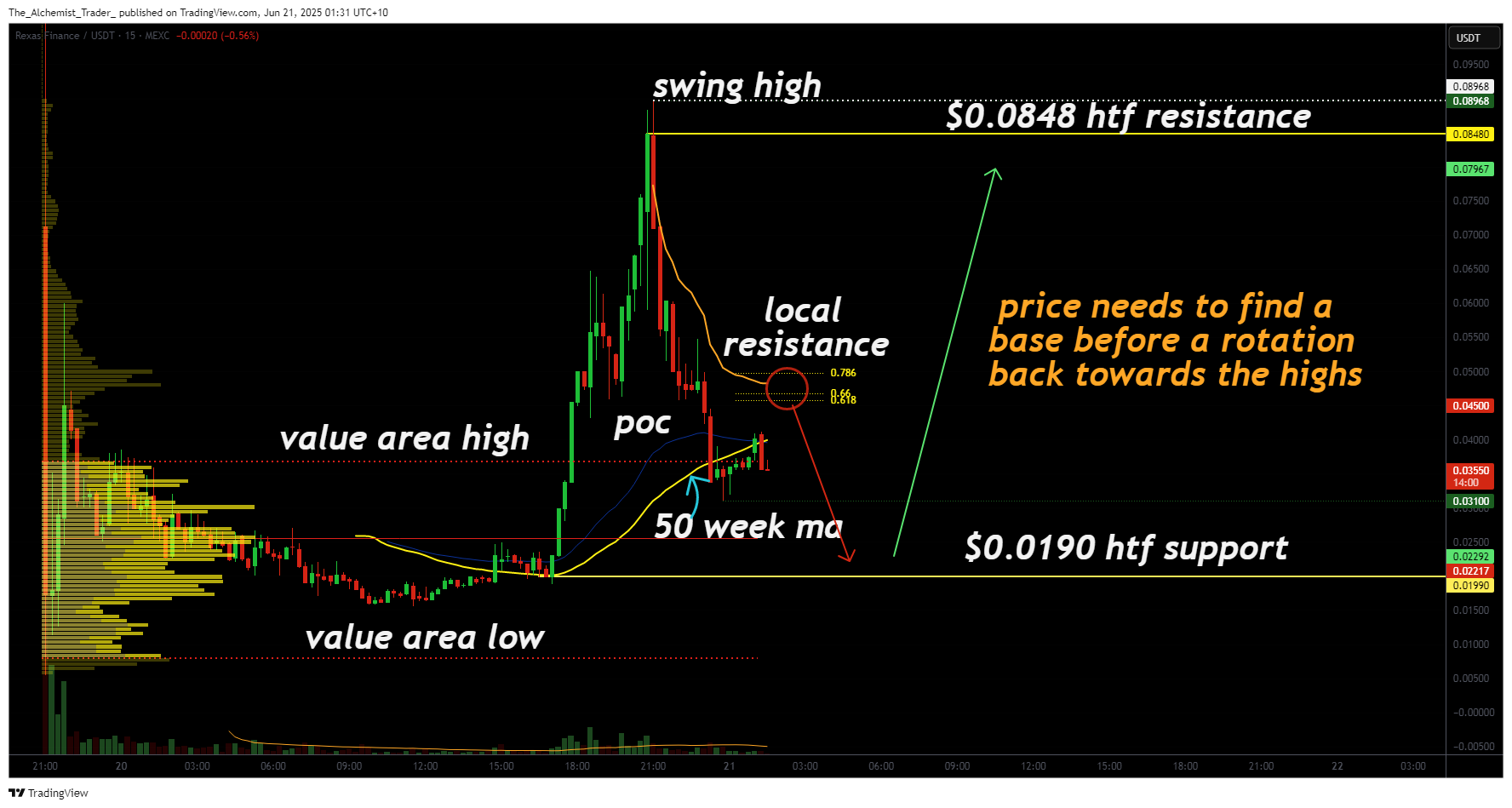

Key technical points,

- High Time Frame Support: $0.109; yet to be retested

- Volume Profile: Declining volume post-rally hints at consolidation, not collapse

- Point of Control: Aligns with $0.109 support, adds strong confluence

- Local Resistance: 0.618 Fibonacci retracement on the recent drop

- Market Structure: No confirmed top or lower low established yet

Following the break above the value area high, RXS surged into a vertical rally that topped out over 325% from its prior base. While such explosive price action often signals exhaustion, the correction that has followed appears controlled and consistent with standard market behavior after large impulsive moves.

Importantly, the decline in volume during the correction phase is typical in scenarios where the market is searching for a higher low or new base, not necessarily signs of collapse. The $0.109 support level stands out as a critical zone. Not only does this level mark high time frame support, but it also aligns with the point of control from previous volume activity, making it a strong candidate for a bullish reaction if tested.

Meanwhile, local resistance resides at the 0.618 Fibonacci retracement of the recent pullback. If price pushes up into this zone and fails to break through, a rejection could send RXS back toward the $0.109 level, offering a potential base-building opportunity before any continuation.

While price action remains volatile, the structure hasn’t broken down. There’s no official lower low, and no bearish market structure has been established. This suggests the market may still be in a healthy corrective state rather than reversing altogether.

What to expect in the coming price Action

As RXS consolidates, keep a close eye on whether it forms a bottoming structure near $0.109. A strong reaction from that support, especially with an uptick in volume, could trigger another leg higher. Until a lower low is printed or key support fails, the bullish narrative remains intact.