Crypto markets saw 9.9% gains in April, led by Bitcoin, as tariff pauses boosted sentiment.

Bitcoin (BTC) strengthened its dominance even as crypto markets are recovering. On Tuesday, May 6, Binance Research released a report on the state of the crypto markets in April. The report points out that the markets have recovered, gaining 9.9% over the month, largely thanks to pauses on tariffs.

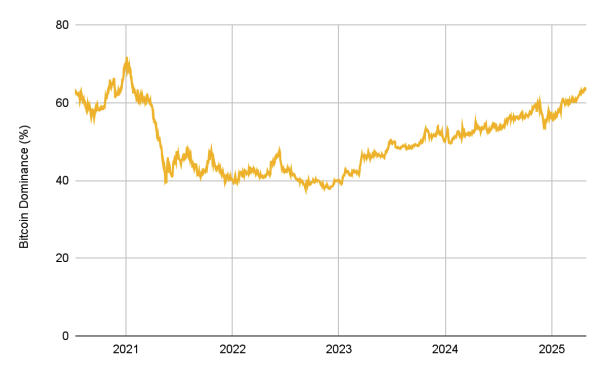

Despite the broader recovery, Bitcoin’s dominance has continued its steady rise, a trend ongoing since 2022. Currently, Bitcoin accounts for 63% of the total crypto market cap, the highest share since 2021. According to Binance Research, the growing discussion around a Bitcoin strategic reserve and the digital gold narrative has increased its appeal to investors.

Periods when Bitcoin dominance fell often coincided with broader bull markets, most recently in late 2024. However, April’s increase suggests the narrative around BTC is evolving, as the asset moves further into the financial mainstream.

A rise in money printing boosts Bitcoin

One of the trends that coincided with Bitcoin’s rise was a steep increase in the money supply. Notably, the M2 measure of money supply for the G4 countries is projected to increase by a record $93 trillion. This expansion in the U.S. Japan, China, and Europe’s money supply is positively correlated with Bitcoin’s price.

For one, Bitcoin supporters see it as digital gold and a hedge against inflation. Moreover, the increase in money supply helps add more liquidity to the markets, including crypto markets.

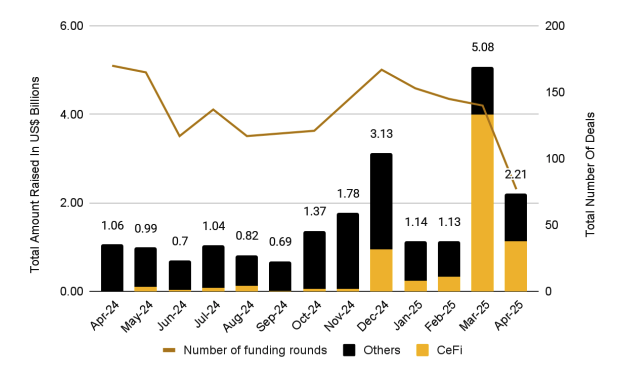

Aside from Bitcoin’s potential decoupling from crypto markets, Binance Reserch also pointed out a new trend in centralized finance. In past two months was the sharp increase in the money raised by centralized finance companies.

According to Binance, CeFi companies are more attractive to investors thanks to a shift in regulations around crypto in the U.S., which continues to be the world’s venture capital hub.